Page 309 - Mansfieldr FY20 Approved Budget

P. 309

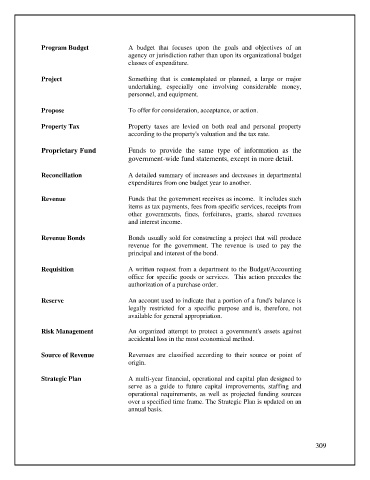

Program Budget A budget that focuses upon the goals and objectives of an

agency or jurisdiction rather than upon its organizational budget

classes of expenditure.

Project Something that is contemplated or planned, a large or major

undertaking, especially one involving considerable money,

personnel, and equipment.

Propose To offer for consideration, acceptance, or action.

Property Tax Property taxes are levied on both real and personal property

according to the property's valuation and the tax rate.

Proprietary Fund Funds to provide the same type of information as the

government-wide fund statements, except in more detail.

Reconciliation A detailed summary of increases and decreases in departmental

expenditures from one budget year to another.

Revenue Funds that the government receives as income. It includes such

items as tax payments, fees from specific services, receipts from

other governments, fines, forfeitures, grants, shared revenues

and interest income.

Revenue Bonds Bonds usually sold for constructing a project that will produce

revenue for the government. The revenue is used to pay the

principal and interest of the bond.

Requisition A written request from a department to the Budget/Accounting

office for specific goods or services. This action precedes the

authorization of a purchase order.

Reserve An account used to indicate that a portion of a fund's balance is

legally restricted for a specific purpose and is, therefore, not

available for general appropriation.

Risk Management An organized attempt to protect a government's assets against

accidental loss in the most economical method.

Source of Revenue Revenues are classified according to their source or point of

origin.

Strategic Plan A multi-year financial, operational and capital plan designed to

serve as a guide to future capital improvements, staffing and

operational requirements, as well as projected funding sources

over a specified time frame. The Strategic Plan is updated on an

annual basis.

309