Page 63 - Keller FY20 Approved Budget

P. 63

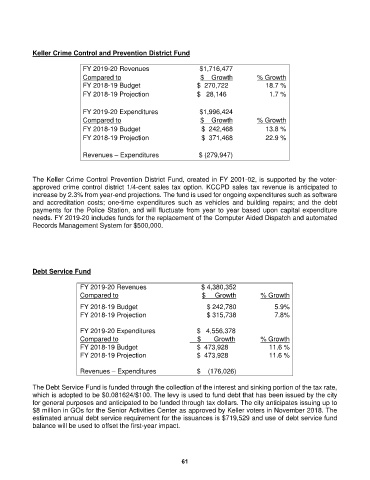

Keller Crime Control and Prevention District Fund

FY 2019-20 Revenues $1,716,477

Compared to $ Growth % Growth

FY 2018-19 Budget $ 270,722 18.7 %

FY 2018-19 Projection $ 28,146 1.7 %

FY 2019-20 Expenditures $1,996,424

Compared to $ Growth % Growth

FY 2018-19 Budget $ 242,468 13.8 %

FY 2018-19 Projection $ 371,468 22.9 %

Revenues – Expenditures $ (279,947)

The Keller Crime Control Prevention District Fund, created in FY 2001-02, is supported by the voter-

approved crime control district 1/4-cent sales tax option. KCCPD sales tax revenue is anticipated to

increase by 2.3% from year-end projections. The fund is used for ongoing expenditures such as software

and accreditation costs; one-time expenditures such as vehicles and building repairs; and the debt

payments for the Police Station, and will fluctuate from year to year based upon capital expenditure

needs. FY 2019-20 includes funds for the replacement of the Computer Aided Dispatch and automated

Records Management System for $500,000.

Debt Service Fund

FY 2019-20 Revenues $ 4,380,352

Compared to $ Growth % Growth

FY 2018-19 Budget $ 242,780 5.9%

FY 2018-19 Projection $ 315,738 7.8%

FY 2019-20 Expenditures $ 4,556,378

Compared to $ Growth % Growth

FY 2018-19 Budget $ 473,928 11.6 %

FY 2018-19 Projection $ 473,928 11.6 %

Revenues – Expenditures $ (176,026)

The Debt Service Fund is funded through the collection of the interest and sinking portion of the tax rate,

which is adopted to be $0.081624/$100. The levy is used to fund debt that has been issued by the city

for general purposes and anticipated to be funded through tax dollars. The city anticipates issuing up to

$8 million in GOs for the Senior Activities Center as approved by Keller voters in November 2018. The

estimated annual debt service requirement for the issuances is $719,529 and use of debt service fund

balance will be used to offset the first-year impact.

61