Page 444 - Keller FY20 Approved Budget

P. 444

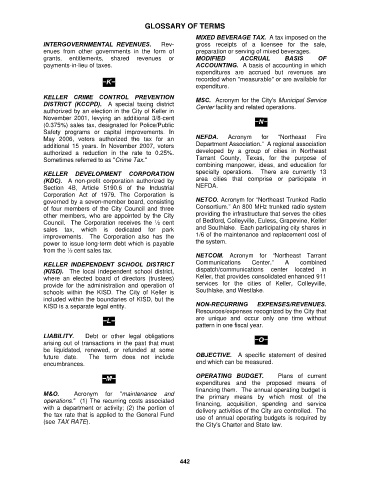

GLOSSARY OF TERMS

MIXED BEVERAGE TAX. A tax imposed on the

INTERGOVERNMENTAL REVENUES. Rev- gross receipts of a licensee for the sale,

enues from other governments in the form of preparation or serving of mixed beverages.

grants, entitlements, shared revenues or MODIFIED ACCRUAL BASIS OF

payments-in-lieu of taxes. ACCOUNTING. A basis of accounting in which

expenditures are accrued but revenues are

−K− recorded when "measurable" or are available for

expenditure.

KELLER CRIME CONTROL PREVENTION MSC. Acronym for the City's Municipal Service

DISTRICT (KCCPD). A special taxing district Center facility and related operations.

authorized by an election in the City of Keller in

November 2001, levying an additional 3/8-cent

(0.375%) sales tax, designated for Police/Public −N−

Safety programs or capital improvements. In

May 2006, voters authorized the tax for an NEFDA. Acronym for “Northeast Fire

additional 15 years. In November 2007, voters Department Association.” A regional association

authorized a reduction in the rate to 0.25%. developed by a group of cities in Northeast

Sometimes referred to as "Crime Tax." Tarrant County, Texas, for the purpose of

combining manpower, ideas, and education for

KELLER DEVELOPMENT CORPORATION specialty operations. There are currently 13

(KDC). A non-profit corporation authorized by area cities that comprise or participate in

Section 4B, Article 5190.6 of the Industrial NEFDA.

Corporation Act of 1979. The Corporation is

governed by a seven-member board, consisting NETCO. Acronym for “Northeast Trunked Radio

of four members of the City Council and three Consortium.” An 800 MHz trunked radio system

other members, who are appointed by the City providing the infrastructure that serves the cities

Council. The Corporation receives the ½ cent of Bedford, Colleyville, Euless, Grapevine, Keller

sales tax, which is dedicated for park and Southlake. Each participating city shares in

improvements. The Corporation also has the 1/6 of the maintenance and replacement cost of

power to issue long-term debt which is payable the system.

from the ½ cent sales tax.

NETCOM. Acronym for “Northeast Tarrant

KELLER INDEPENDENT SCHOOL DISTRICT Communications Center.” A combined

(KISD). The local independent school district, dispatch/communications center located in

where an elected board of directors (trustees) Keller, that provides consolidated enhanced 911

provide for the administration and operation of services for the cities of Keller, Colleyville,

schools within the KISD. The City of Keller is Southlake, and Westlake.

included within the boundaries of KISD, but the

KISD is a separate legal entity. NON-RECURRING EXPENSES/REVENUES.

Resources/expenses recognized by the City that

−L− are unique and occur only one time without

pattern in one fiscal year.

LIABILITY. Debt or other legal obligations

arising out of transactions in the past that must −O−

be liquidated, renewed, or refunded at some

future date. The term does not include OBJECTIVE. A specific statement of desired

encumbrances. end which can be measured.

−M− OPERATING BUDGET. Plans of current

expenditures and the proposed means of

financing them. The annual operating budget is

M&O. Acronym for "maintenance and the primary means by which most of the

operations." (1) The recurring costs associated financing, acquisition, spending and service

with a department or activity; (2) the portion of delivery activities of the City are controlled. The

the tax rate that is applied to the General Fund use of annual operating budgets is required by

(see TAX RATE). the City's Charter and State law.

442