Page 442 - Keller FY20 Approved Budget

P. 442

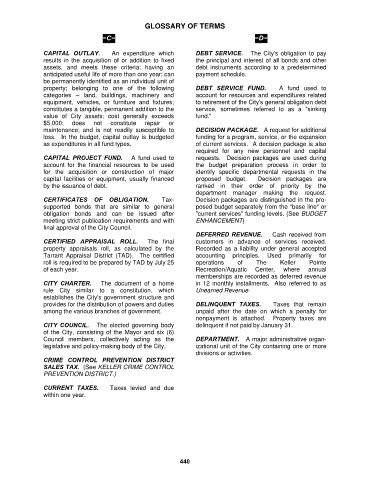

GLOSSARY OF TERMS

−C− −D−

CAPITAL OUTLAY. An expenditure which DEBT SERVICE. The City's obligation to pay

results in the acquisition of or addition to fixed the principal and interest of all bonds and other

assets, and meets these criteria: having an debt instruments according to a predetermined

anticipated useful life of more than one year; can payment schedule.

be permanently identified as an individual unit of

property; belonging to one of the following DEBT SERVICE FUND. A fund used to

categories – land, buildings, machinery and account for resources and expenditures related

equipment, vehicles, or furniture and fixtures; to retirement of the City's general obligation debt

constitutes a tangible, permanent addition to the service, sometimes referred to as a "sinking

value of City assets; cost generally exceeds fund."

$5,000; does not constitute repair or

maintenance; and is not readily susceptible to DECISION PACKAGE. A request for additional

loss. In the budget, capital outlay is budgeted funding for a program, service, or the expansion

as expenditures in all fund types. of current services. A decision package is also

required for any new personnel and capital

CAPITAL PROJECT FUND. A fund used to requests. Decision packages are used during

account for the financial resources to be used the budget preparation process in order to

for the acquisition or construction of major identify specific departmental requests in the

capital facilities or equipment, usually financed proposed budget. Decision packages are

by the issuance of debt. ranked in their order of priority by the

department manager making the request.

CERTIFICATES OF OBLIGATION. Tax- Decision packages are distinguished in the pro-

supported bonds that are similar to general posed budget separately from the "base line" or

obligation bonds and can be issued after "current services" funding levels. (See BUDGET

meeting strict publication requirements and with ENHANCEMENT)

final approval of the City Council.

DEFERRED REVENUE. Cash received from

CERTIFIED APPRAISAL ROLL. The final customers in advance of services received.

property appraisals roll, as calculated by the Recorded as a liability under general accepted

Tarrant Appraisal District (TAD). The certified accounting principles. Used primarily for

roll is required to be prepared by TAD by July 25 operations of The Keller Pointe

of each year. Recreation/Aquatic Center, where annual

memberships are recorded as deferred revenue

CITY CHARTER. The document of a home in 12 monthly installments. Also referred to as

rule City similar to a constitution, which Unearned Revenue.

establishes the City's government structure and

provides for the distribution of powers and duties DELINQUENT TAXES. Taxes that remain

among the various branches of government. unpaid after the date on which a penalty for

nonpayment is attached. Property taxes are

CITY COUNCIL. The elected governing body delinquent if not paid by January 31.

of the City, consisting of the Mayor and six (6)

Council members, collectively acting as the DEPARTMENT. A major administrative organ-

legislative and policy-making body of the City. izational unit of the City containing one or more

divisions or activities.

CRIME CONTROL PREVENTION DISTRICT

SALES TAX. (See KELLER CRIME CONTROL

PREVENTION DISTRICT.)

CURRENT TAXES. Taxes levied and due

within one year.

440