Page 301 - Keller FY20 Approved Budget

P. 301

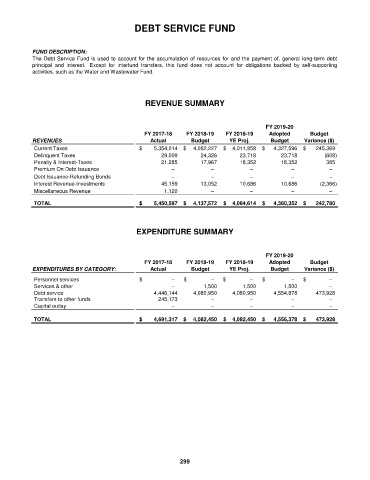

DEBT SERVICE FUND

FUND DESCRIPTION:

The Debt Service Fund is used to account for the accumulation of resources for and the payment of, general long-term debt

principal and interest. Except for interfund transfers, this fund does not account for obligations backed by self-supporting

activities, such as the Water and Wastewater Fund.

REVENUE SUMMARY

FY 2019-20

FY 2017-18 FY 2018-19 FY 2018-19 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Current Taxes $ 5,354,014 $ 4,082,227 $ 4,011,858 $ 4,327,596 $ 245,369

Delinquent Taxes 29,009 24,326 23,718 23,718 (608)

Penalty & Interest-Taxes 21,285 17,967 18,352 18,352 385

Premium On Debt Issuance – – – – –

Debt Issuance-Refunding Bonds – – – – –

Interest Revenue-Investments 45,159 13,052 10,686 10,686 (2,366)

Miscellaneous Revenue 1,120 – – – –

TOTAL $ 5,450,587 $ 4,137,572 $ 4,064,614 $ 4,380,352 $ 242,780

EXPENDITURE SUMMARY

FY 2019-20

FY 2017-18 FY 2018-19 FY 2018-19 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services $ – $ – $ – $ – $ –

Services & other – 1,500 1,500 1,500 –

Debt service 4,446,144 4,080,950 4,080,950 4,554,878 473,928

Transfers to other funds 245,173 – – – –

Capital outlay – – – – –

TOTAL $ 4,691,317 $ 4,082,450 $ 4,082,450 $ 4,556,378 $ 473,928

299