Page 91 - Hurst FY20 Approved Budget

P. 91

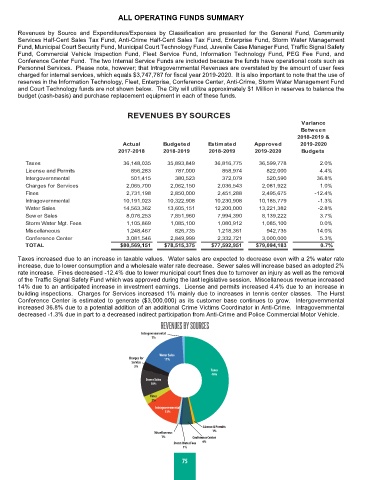

ALL OPERATING FUNDS SUMMARY

Revenues by Source and Expenditures/Expenses by Classification are presented for the General Fund, Community

Services Half-Cent Sales Tax Fund, Anti-Crime Half-Cent Sales Tax Fund, Enterprise Fund, Storm Water Management

Fund, Municipal Court Security Fund, Municipal Court Technology Fund, Juvenile Case Manager Fund, Traffic Signal Safety

Fund, Commercial Vehicle Inspection Fund, Fleet Service Fund, Information Technology Fund, PEG Fee Fund, and

Conference Center Fund. The two Internal Service Funds are included because the funds have operational costs such as

Personnel Services. Please note, however; that Intragovernmental Revenues are overstated by the amount of user fees

charged for internal services, which equals $3,747,787 for fiscal year 2019-2020. It is also important to note that the use of

reserves in the Information Technology, Fleet, Enterprise, Conference Center, Anti-Crime, Storm Water Management Fund

and Court Technology funds are not shown below. The City will utilize approximately $1 Million in reserves to balance the

budget (cash-basis) and purchase replacement equipment in each of these funds.

REVENUES BY SOURCES

Variance

Between

2018-2019 &

Actual Budgeted Estimated Approved 2019-2020

2017-2018 2018-2019 2018-2019 2019-2020 Budgets

Taxes 36,148,035 35,893,849 36,816,775 36,599,778 2.0%

License and Permits 856,283 787,000 858,974 822,000 4.4%

Intergovernmental 501,415 380,523 372,079 520,590 36.8%

Charges for Services 2,065,700 2,062,150 2,036,543 2,081,922 1.0%

Fines 2,731,198 2,850,000 2,451,288 2,495,675 -12.4%

Intragovernmental 10,191,023 10,322,908 10,230,908 10,185,779 -1.3%

Water Sales 14,563,362 13,605,151 12,200,000 13,221,382 -2.8%

Sew er Sales 8,076,253 7,851,960 7,994,390 8,139,222 3.7%

Storm Water Mgt. Fees 1,105,869 1,085,100 1,080,912 1,085,100 0.0%

Miscellaneous 1,248,467 826,735 1,218,361 942,735 14.0%

Conference Center 3,081,546 2,849,999 2,332,721 3,000,000 5.3%

TOTAL $80,569,151 $78,515,375 $77,592,951 $79,094,183 0.7%

Taxes increased due to an increase in taxable values. Water sales are expected to decrease even with a 2% water rate

increase, due to lower consumption and a wholesale water rate decrease. Sewer sales will increase based an adopted 2%

rate increase. Fines decreased -12.4% due to lower municipal court fines due to turnover an injury as well as the removal

of the Traffic Signal Safety Fund which was approved during the last legislative session. Miscellaneous revenue increased

14% due to an anticipated increase in investment earnings. License and permits increased 4.4% due to an increase in

building inspections. Charges for Services increased 1% mainly due to increases in tennis center classes. The Hurst

Conference Center is estimated to generate ($3,000,000) as its customer base continues to grow. Intergovernmental

increased 36.8% due to a potential addition of an additional Crime Victims Coordinator in Anti-Crime. Intragovernmental

�

decreased -1.3% due in part to a decreased indirect participation from Anti-Crime and Police Commercial Motor Vehicle.

REVENUES BY SOURCES

Taxes

Intergovernmental

46% 1%

Intergovernmental

1%

Water Sales

Charges for 17%

License & Permits Service � � � � � � � ��� � � � � � � � � � � � �

1% 3% Taxes

46%

Sewer Sales

Conference Center 10% Water Sales

4% 17%

Fines

3%

Storm Water Fees Intragovernmental

1% 13%

Charges for Service

Miscellaneous License & Permits 3%

1% Miscellaneous 1%

Intragovernmental 1% Fines 4% Sewer Sales

Conference Center

13% Storm Water Fees 10%

3%

1%

75