Page 114 - Hurst FY20 Approved Budget

P. 114

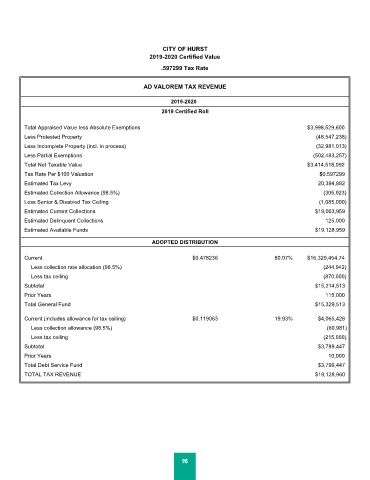

CITY OF HURST

2019-2020 Certified Value

.597299 Tax Rate

AD VALOREM TAX REVENUE

2019-2020

2019 Certified Roll

Total Appraised Value less Absolute Exemptions $3,998,529,600

Less Protested Property (48,547,238)

Less Incomplete Property (incl. in process) (32,981,013)

Less Partial Exemptions (502,483,257)

Total Net Taxable Value $3,414,518,092

Tax Rate Per $100 Valuation $0.597299

Estimated Tax Levy 20,394,882

Estimated Collection Allowance (98.5%) (305,923)

Less Senior & Disabled Tax Ceiling (1,085,000)

Estimated Current Collections $19,003,959

Estimated Delinquent Collections 125,000

Estimated Available Funds $19,128,959

ADOPTED DISTRIBUTION

Current $0.478236 80.07% $16,329,454.74

Less collection rate allocation (98.5%) (244,942)

Less tax ceiling (870,000)

Subtotal $15,214,513

Prior Years 115,000

Total General Fund $15,329,513

Current (includes allowance for tax ceiling) $0.119063 19.93% $4,065,428

Less collection allowance (98.5%) (60,981)

Less tax ceiling (215,000)

Subtotal $3,789,447

Prior Years 10,000

Total Debt Service Fund $3,799,447

TOTAL TAX REVENUE $19,128,960

98