Page 110 - Hurst FY20 Approved Budget

P. 110

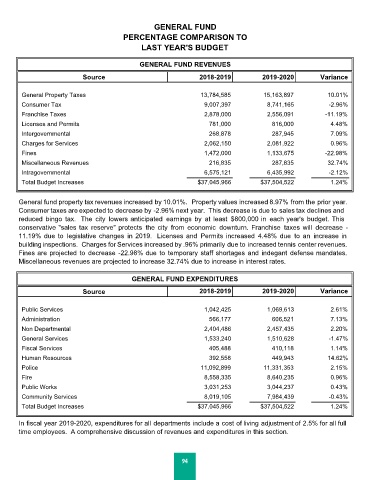

GENERAL FUND

PERCENTAGE COMPARISON TO

LAST YEAR'S BUDGET

GENERAL FUND REVENUES

Source 2018-2019 2019-2020 Variance

General Property Taxes 13,784,585 15,163,897 10.01%

Consumer Tax 9,007,397 8,741,165 -2.96%

Franchise Taxes 2,878,000 2,556,091 -11.19%

Licenses and Permits 781,000 816,000 4.48%

Intergovernmental 268,878 287,945 7.09%

Charges for Services 2,062,150 2,081,922 0.96%

Fines 1,472,000 1,133,675 -22.98%

Miscellaneous Revenues 216,835 287,835 32.74%

Intragovernmental 6,575,121 6,435,992 -2.12%

Total Budget Increases $37,045,966 $37,504,522 1.24%

General fund property tax revenues increased by 10.01%. Property values increased 8.97% from the prior year.

Consumer taxes are expected to decrease by -2.96% next year. This decrease is due to sales tax declines and

reduced bingo tax. The city lowers anticipated earnings by at least $800,000 in each year's budget. This

conservative "sales tax reserve" protects the city from economic downturn. Franchise taxes will decrease -

11.19% due to legislative changes in 2019. Licenses and Permits increased 4.48% due to an increase in

building inspections. Charges for Services increased by .96% primarily due to increased tennis center revenues.

Fines are projected to decrease -22.98% due to temporary staff shortages and indegant defense mandates.

Miscellaneous revenues are projected to increase 32.74% due to increase in interest rates.

GENERAL FUND EXPENDITURES

Source 2018-2019 2019-2020 Variance

Public Services 1,042,425 1,069,613 2.61%

Administration 566,177 606,521 7.13%

Non Departmental 2,404,486 2,457,435 2.20%

General Services 1,533,240 1,510,628 -1.47%

Fiscal Services 405,488 410,118 1.14%

Human Resources 392,558 449,943 14.62%

Police 11,092,899 11,331,353 2.15%

Fire 8,558,335 8,640,235 0.96%

Public Works 3,031,253 3,044,237 0.43%

Community Services 8,019,105 7,984,439 -0.43%

Total Budget Increases $37,045,966 $37,504,522 1.24%

In fiscal year 2019-2020, expenditures for all departments include a cost of living adjustment of 2.5% for all full

time employees. A comprehensive discussion of revenues and expenditures in this section.

94