Page 286 - Grapevine FY20 Approved Budget

P. 286

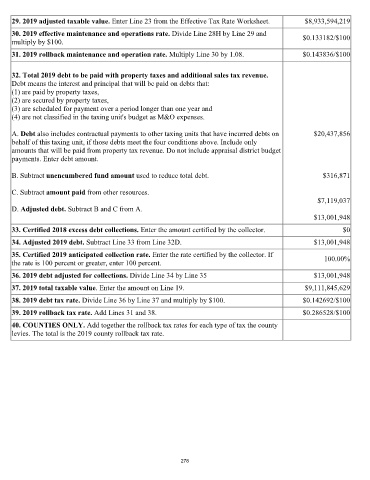

29. 2019 adjusted taxable value. Enter Line 23 from the Effective Tax Rate Worksheet. $8,933,594,219

30. 2019 effective maintenance and operations rate. Divide Line 28H by Line 29 and $0.133182/$100

multiply by $100.

31. 2019 rollback maintenance and operation rate. Multiply Line 30 by 1.08. $0.143836/$100

32. Total 2019 debt to be paid with property taxes and additional sales tax revenue.

Debt means the interest and principal that will be paid on debts that:

(1) are paid by property taxes,

(2) are secured by property taxes,

(3) are scheduled for payment over a period longer than one year and

(4) are not classified in the taxing unit's budget as M&O expenses.

A. Debt also includes contractual payments to other taxing units that have incurred debts on $20,437,856

behalf of this taxing unit, if those debts meet the four conditions above. Include only

amounts that will be paid from property tax revenue. Do not include appraisal district budget

payments. Enter debt amount.

B. Subtract unencumbered fund amount used to reduce total debt. $316,871

C. Subtract amount paid from other resources.

$7,119,037

D. Adjusted debt. Subtract B and C from A.

$13,001,948

33. Certified 2018 excess debt collections. Enter the amount certified by the collector. $0

34. Adjusted 2019 debt. Subtract Line 33 from Line 32D. $13,001,948

35. Certified 2019 anticipated collection rate. Enter the rate certified by the collector. If 100.00%

the rate is 100 percent or greater, enter 100 percent.

36. 2019 debt adjusted for collections. Divide Line 34 by Line 35 $13,001,948

37. 2019 total taxable value. Enter the amount on Line 19. $9,111,845,629

38. 2019 debt tax rate. Divide Line 36 by Line 37 and multiply by $100. $0.142692/$100

39. 2019 rollback tax rate. Add Lines 31 and 38. $0.286528/$100

40. COUNTIES ONLY. Add together the rollback tax rates for each type of tax the county

levies. The total is the 2019 county rollback tax rate.

278