Page 282 - Grapevine FY20 Approved Budget

P. 282

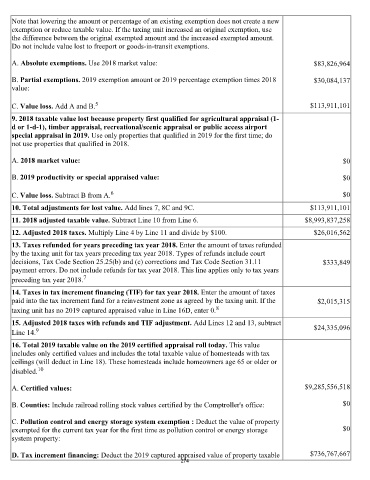

Note that lowering the amount or percentage of an existing exemption does not create a new

exemption or reduce taxable value. If the taxing unit increased an original exemption, use

the difference between the original exempted amount and the increased exempted amount.

Do not include value lost to freeport or goods-in-transit exemptions.

A. Absolute exemptions. Use 2018 market value: $83,826,964

B. Partial exemptions. 2019 exemption amount or 2019 percentage exemption times 2018 $30,084,137

value:

C. Value loss. Add A and B. 5 $113,911,101

9. 2018 taxable value lost because property first qualified for agricultural appraisal (1-

d or 1-d-1), timber appraisal, recreational/scenic appraisal or public access airport

special appraisal in 2019. Use only properties that qualified in 2019 for the first time; do

not use properties that qualified in 2018.

A. 2018 market value: $0

B. 2019 productivity or special appraised value: $0

C. Value loss. Subtract B from A. 6 $0

10. Total adjustments for lost value. Add lines 7, 8C and 9C. $113,911,101

11. 2018 adjusted taxable value. Subtract Line 10 from Line 6. $8,993,837,258

12. Adjusted 2018 taxes. Multiply Line 4 by Line 11 and divide by $100. $26,016,562

13. Taxes refunded for years preceding tax year 2018. Enter the amount of taxes refunded

by the taxing unit for tax years preceding tax year 2018. Types of refunds include court

decisions, Tax Code Section 25.25(b) and (c) corrections and Tax Code Section 31.11 $333,849

payment errors. Do not include refunds for tax year 2018. This line applies only to tax years

preceding tax year 2018. 7

14. Taxes in tax increment financing (TIF) for tax year 2018. Enter the amount of taxes

paid into the tax increment fund for a reinvestment zone as agreed by the taxing unit. If the $2,015,315

8

taxing unit has no 2019 captured appraised value in Line 16D, enter 0.

15. Adjusted 2018 taxes with refunds and TIF adjustment. Add Lines 12 and 13, subtract

9

Line 14. $24,335,096

16. Total 2019 taxable value on the 2019 certified appraisal roll today. This value

includes only certified values and includes the total taxable value of homesteads with tax

ceilings (will deduct in Line 18). These homesteads include homeowners age 65 or older or

disabled. 10

A. Certified values: $9,285,556,518

B. Counties: Include railroad rolling stock values certified by the Comptroller's office: $0

C. Pollution control and energy storage system exemption : Deduct the value of property

exempted for the current tax year for the first time as pollution control or energy storage $0

system property:

D. Tax increment financing: Deduct the 2019 captured appraised value of property taxable $736,767,667

274