Page 84 - Forest Hill FY20 Annual Budget

P. 84

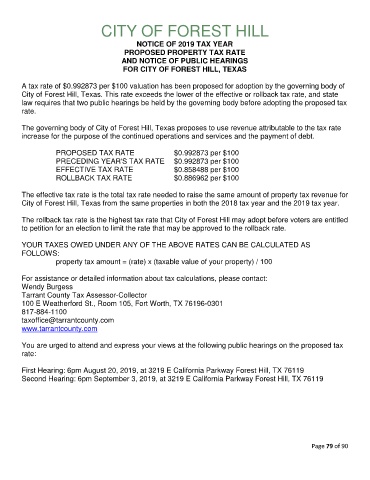

CITY OF FOREST HILL

NOTICE OF 2019 TAX YEAR

PROPOSED PROPERTY TAX RATE

AND NOTICE OF PUBLIC HEARINGS

FOR CITY OF FOREST HILL, TEXAS

A tax rate of $0.992873 per $100 valuation has been proposed for adoption by the governing body of

City of Forest Hill, Texas. This rate exceeds the lower of the effective or rollback tax rate, and state

law requires that two public hearings be held by the governing body before adopting the proposed tax

rate.

The governing body of City of Forest Hill, Texas proposes to use revenue attributable to the tax rate

increase for the purpose of the continued operations and services and the payment of debt.

PROPOSED TAX RATE $0.992873 per $100

PRECEDING YEAR'S TAX RATE $0.992873 per $100

EFFECTIVE TAX RATE $0.858488 per $100

ROLLBACK TAX RATE $0.886962 per $100

The effective tax rate is the total tax rate needed to raise the same amount of property tax revenue for

City of Forest Hill, Texas from the same properties in both the 2018 tax year and the 2019 tax year.

The rollback tax rate is the highest tax rate that City of Forest Hill may adopt before voters are entitled

to petition for an election to limit the rate that may be approved to the rollback rate.

YOUR TAXES OWED UNDER ANY OF THE ABOVE RATES CAN BE CALCULATED AS

FOLLOWS:

property tax amount = (rate) x (taxable value of your property) / 100

For assistance or detailed information about tax calculations, please contact:

Wendy Burgess

Tarrant County Tax Assessor-Collector

100 E Weatherford St., Room 105, Fort Worth, TX 76196-0301

817-884-1100

taxoffice@tarrantcounty.com

www.tarrantcounty.com

You are urged to attend and express your views at the following public hearings on the proposed tax

rate:

First Hearing: 6pm August 20, 2019, at 3219 E California Parkway Forest Hill, TX 76119

Second Hearing: 6pm September 3, 2019, at 3219 E California Parkway Forest Hill, TX 76119

Page 79 of 90