Page 54 - FY2020Colleyville

P. 54

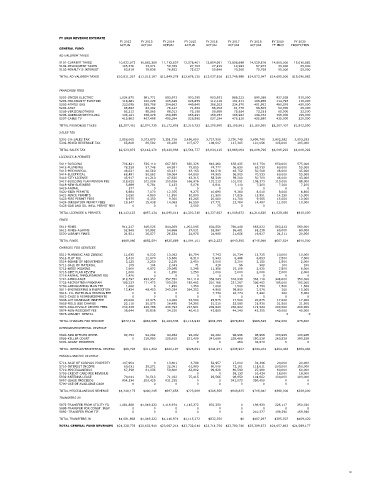

FY 2020 REVENUE ESTIMATE

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020

ACTUAL ACTUAL ACTUAL ACTUAL ACTUAL ACTUAL ACTUAL YE PROJ PROJECTION

GENERAL FUND

AD VALOREM TAXES

5101-CURRENT TAXES 10,622,072 10,862,289 11,712,637 12,578,401 12,954,951 13,658,699 14,529,616 14,600,000 15,010,882

5102-DELINQUENT TAXES 105,376 73,071 59,789 27,703 27,219 19,923 67,973 30,000 25,000

5103-PENALTY & INTEREST 83,819 79,838 76,852 72,027 55,646 70,366 75,758 55,000 55,000

TOTAL AD VALOREM TAXES $10,811,267 $11,015,197 $11,849,278 $12,678,130 $13,037,816 $13,748,988 $14,673,347 $14,685,000 $15,090,882

FRANCHISE FEES

5201-ONCOR ELECTRIC 1,024,875 891,771 893,973 903,390 903,933 889,222 890,388 927,038 910,000

5202-TRI-COUNTY ELECTRIC 118,281 100,229 105,326 126,855 112,116 101,311 105,858 114,793 110,000

5203-ATMOS GAS 333,098 289,708 354,663 449,640 368,202 334,570 401,952 480,576 450,000

5204-AT&T 86,852 83,482 76,147 71,354 66,702 61,776 55,509 50,000 25,000

5205-VERIZON/OTHERS 82,212 85,565 88,013 75,198 59,956 75,934 73,191 65,000 32,500

5206-GARBAGE/RECYCLING 146,181 156,478 159,285 166,291 168,787 166,942 198,372 195,000 195,000

5207-CABLE TV 415,962 467,498 495,394 526,995 527,194 476,126 455,680 435,000 220,000

TOTAL FRANCHISE TAXES $2,207,461 $2,074,730 $2,172,801 $2,319,723 $2,206,890 $2,105,881 $2,180,950 $2,267,407 $1,942,500

SALES TAX

5301-1% SALES TAX 2,858,065 3,073,879 3,351,728 3,456,800 3,727,508 3,750,749 3,898,740 3,903,292 3,903,292

5302-MIXED BEVERAGE TAX 65,808 68,592 98,160 107,977 106,607 117,315 110,056 105,000 105,000

TOTAL SALES TAX $2,923,873 $3,142,470 $3,449,888 $3,564,777 $3,834,115 $3,868,064 $4,008,796 $4,008,292 $4,008,292

LICENSES & PERMITS

5411-BUILDING 706,421 526,110 667,583 850,326 846,260 658,435 813,754 650,000 575,000

5412-PLUMBING 78,329 57,748 64,991 75,655 74,777 56,650 65,539 60,000 55,000

5413-MECHANICAL 48,621 40,560 43,421 43,163 64,518 48,752 50,508 48,000 45,000

5414-ELECTRICAL 68,491 50,062 58,064 64,800 74,905 56,905 70,533 60,000 55,000

5416-CITY LICENSE 45,917 41,210 47,620 43,315 58,349 59,200 50,700 46,000 43,000

5417-BUILDING PLAN REVIEW FEE 118,622 102,006 155,636 166,976 132,212 101,051 108,373 110,000 88,000

5418-NEW BUSINESS 5,689 5,781 5,123 5,076 6,811 7,110 7,200 7,200 7,200

5419-ANIMAL 577 0 0 0 0 0 0 0 0

5420-SIGN PERMITS 6,884 7,070 12,355 9,275 10,690 9,260 8,010 8,000 6,800

5421-FENCE PERMITS 5,050 4,800 11,850 10,800 21,500 17,826 15,951 14,250 15,000

5423-FIRE PERMIT FEES 8,975 6,350 9,300 15,265 20,060 11,700 9,565 15,000 10,000

5424-IRRIGATION PERMIT FEES 19,547 15,438 14,069 16,559 27,771 22,784 14,487 11,000 10,000

5425-GAS AND OIL WELL PERMIT FEES 0 0 0 2,500 75 0 0

TOTAL LICENSES & PERMITS $1,113,123 $857,134 $1,090,011 $1,303,710 $1,337,927 $1,049,673 $1,214,620 $1,029,450 $910,000

FINES

5611-FINES 911,217 815,025 844,369 1,002,095 834,556 760,448 665,823 583,213 560,000

5612-FINES-ALARMS 52,948 50,992 54,966 57,031 52,997 58,481 61,238 60,000 60,000

5630-LIBRARY FINES 24,921 26,577 26,534 24,975 24,980 21,656 19,927 24,311 20,000

TOTAL FINES $989,086 $892,594 $925,869 $1,084,101 $912,533 $840,585 $746,988 $667,524 $640,000

CHARGES FOR SERVICES

5511-PLANNING AND ZONING 11,635 8,523 13,092 10,794 7,743 10,734 13,725 10,000 10,000

5512-PLAT FEE 5,410 12,870 15,860 8,910 5,943 6,488 8,853 7,500 7,500

5514-BOARD OF ADJUSTMENT 3,125 2,250 2,225 2,450 3,000 3,200 2,150 1,500 2,000

5711-SALE OF MATERIAL 105 104 2,043 71 418 56 969 100 100

5712-WEED MOWING 7,900 6,872 29,985 5,246 11,356 15,108 2,920 7,500 6,000

5715-SITE PLAN REVIEW 1,000 0 1,250 1,250 1,000 2,000 2,000 2,000 2,000

5718-ANIMAL IMPOUNDMENT FEE 1,420 0 0 0 0 0 0 0 0

5721-AMBULANCE 319,797 293,957 357,352 321,119 358,523 316,938 363,118 348,000 350,000

5722-RECREATION PROGRAM 199,233 171,472 193,029 185,462 201,166 231,267 306,492 195,000 195,000

5730-LANDSCAPING PLAN FEE 1,000 0 1,250 1,250 1,000 1,500 1,750 1,500 1,500

5811-ENGINEERING & INSPECTION 12,424 48,453 243,024 264,252 4,908 59,800 2,576 200 15,000

5813- 1% MATERIALS TESTING FEE 0 0 0 0 7,734 16,774 3,292 200 8,000

5812-CHGS & REIMBURSEMENTS 0 0 0 0 0 0 0 0 0

5845-LOT DRAINAGE INSP FEE 20,000 13,375 14,000 23,500 23,875 17,500 20,875 17,000 17,000

5855-FIELD USE CHARGE 22,110 20,575 26,485 24,295 21,510 22,585 21,930 21,500 21,500

5873-COLLEYVILLE CENTER FEES 230,329 246,798 230,793 227,901 209,820 230,612 171,524 200,000 200,000

5874-NON-RESIDENT FEE 36,644 35,838 34,150 40,415 43,800 44,240 43,355 40,000 40,000

5875-LIBRARY RENTAL 0 0

TOTAL CHARGES FOR SERVICE $872,132 $861,085 $1,164,538 $1,116,913 $901,795 $978,802 $965,529 852,000 875,600

INTERGOVERNMENTAL REVENUE

5828-SRO OFFICER REIMB 89,793 94,282 94,282 94,282 94,282 98,996 98,996 103,945 103,945

5826-KELLER COURT 0 216,980 225,915 231,409 247,689 239,468 260,538 260,538 260,538

5902-GRANT PROCEEDS 0 0 463 34,570 0 0

TOTAL INTERGOVERNMENTAL REVENUE $89,793 $311,262 $320,197 $325,691 $341,971 $338,927 $394,104 $364,483 $364,483

MISCELLANEOUS REVENUE

5714-SALE OF SURPLUS PROPERTY 147,969 0 13,801 3,798 52,957 17,000 34,396 20,000 20,000

5716-INTEREST INCOME 60,031 39,271 22,081 61,683 60,008 73,161 111,611 200,000 150,000

5719-MISCELLANEOUS 67,598 81,036 59,600 82,802 99,828 80,599 97,480 60,000 60,000

5759-CREDIT CARD FEE REVENUE 0 0 39,133 16,434 18,000 18,000

5832-ANTENNA LEASE 70,041 70,513 71,022 75,415 93,566 98,859 101,662 100,000 100,000

5867-LEASE PROCEEDS 894,534 209,425 831,155 0 0 541,073 356,459 0 0

5790-USE OF AVAILABLE CASH 0 0 0 0 0 0 0 0 0

TOTAL MISCELLANEOUS REVENUE $1,240,173 $400,245 $997,658 $223,698 $306,359 $849,825 $718,042 $398,000 $348,000

TRANSFERS IN

5872-TRANSFER FROM UTILITY FD 1,081,868 $1,049,222 1,116,974 1,115,272 832,350 0 196,920 226,117 250,030

5888-TRANSFER FOR CONST. INSP. 0 0 0 0 0 0 0 0 0

5892- TRANSFER FROM TIF 0 0 0 0 0 0 210,377 159,390 159,390

TOTAL TRANSFERS IN $1,081,868 $1,049,222 $1,116,974 $1,115,272 $832,350 $0 $407,297 $385,507 $409,420

TOTAL GENERAL FUND REVENUES $21,328,776 $20,603,940 $23,087,214 $23,732,014 $23,711,756 $23,780,746 $25,309,673 $24,657,663 $24,589,177

52