Page 53 - FY2020Colleyville

P. 53

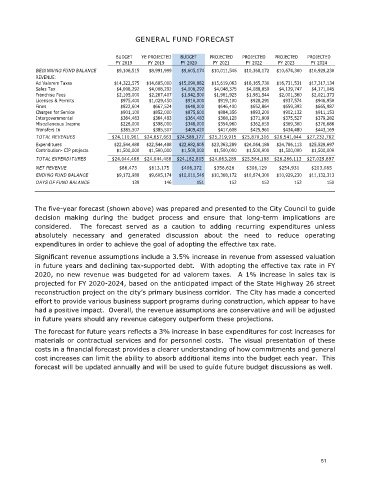

GENERAL FUND FORECAST

BUDGET YE PROJECTED BUDGET PROJECTED PROJECTED PROJECTED PROJECTED

FY 2019 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

BEGINNING FUND BALANCE $9,106,515 $8,991,999 $9,605,174 $10,011,546 $10,368,172 $10,674,300 $10,929,230

REVENUE:

Ad Valorem Taxes $14,322,575 $14,685,000 $15,090,882 $15,619,063 $16,165,730 $16,731,531 $17,317,134

Sales Tax $4,008,292 $4,008,292 $4,008,292 $4,048,375 $4,088,859 $4,129,747 $4,171,045

Franchise Fees $2,105,000 $2,267,407 $1,942,500 $1,961,925 $1,981,544 $2,001,360 $2,021,373

Licenses & Permits $975,400 $1,029,450 $910,000 $919,100 $928,291 $937,574 $946,950

Fines $822,604 $667,524 $640,000 $646,400 $652,864 $659,393 $665,987

Charges for Service $901,100 $852,000 $875,600 $884,356 $893,200 $902,132 $911,153

Intergovernmental $364,483 $364,483 $364,483 $368,128 $371,809 $375,527 $379,282

Miscellaneous Income $226,000 $398,000 $348,000 $354,960 $362,059 $369,300 $376,686

Transfers In $385,507 $385,507 $409,420 $417,608 $425,961 $434,480 $443,169

TOTAL REVENUES $24,110,961 $24,657,663 $24,589,177 $25,219,915 $25,870,316 $26,541,044 $27,232,782

Expenditures $22,544,488 $22,544,488 $22,682,805 $23,363,289 $24,064,188 $24,786,113 $25,529,697

Contribution- CIP projects $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

TOTAL EXPENDITURES $24,044,488 $24,044,488 $24,182,805 $24,863,289 $25,564,188 $26,286,113 $27,029,697

NET REVENUE $66,473 $613,175 $406,372 $356,626 $306,129 $254,931 $203,085

ENDING FUND BALANCE $9,172,988 $9,605,174 $10,011,546 $10,368,172 $10,674,300 $10,929,230 $11,132,313

DAYS OF FUND BALANCE 139 146 151 152 152 152 150

The five-year forecast (shown above) was prepared and presented to the City Council to guide

decision making during the budget process and ensure that long-term implications are

considered. The forecast served as a caution to adding recurring expenditures unless

absolutely necessary and generated discussion about the need to reduce operating

expenditures in order to achieve the goal of adopting the effective tax rate.

Significant revenue assumptions include a 3.5% increase in revenue from assessed valuation

in future years and declining tax-supported debt. With adopting the effective tax rate in FY

2020, no new revenue was budgeted for ad valorem taxes. A 1% increase in sales tax is

projected for FY 2020-2024, based on the anticipated impact of the State Highway 26 street

reconstruction project on the city’s primary business corridor. The City has made a concerted

effort to provide various business support programs during construction, which appear to have

had a positive impact. Overall, the revenue assumptions are conservative and will be adjusted

in future years should any revenue category outperform these projections.

The forecast for future years reflects a 3% increase in base expenditures for cost increases for

materials or contractual services and for personnel costs. The visual presentation of these

costs in a financial forecast provides a clearer understanding of how commitments and general

cost increases can limit the ability to absorb additional items into the budget each year. This

forecast will be updated annually and will be used to guide future budget discussions as well.

51