Page 254 - Benbrook FY20 Approved Budget

P. 254

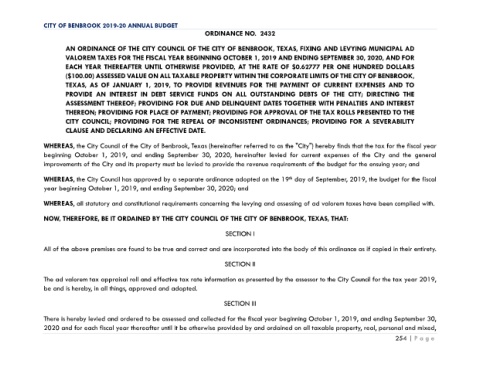

CITY OF BENBROOK 2019-20 ANNUAL BUDGET

ORDINANCE NO. 2432

AN ORDINANCE OF THE CITY COUNCIL OF THE CITY OF BENBROOK, TEXAS, FIXING AND LEVYING MUNICIPAL AD

VALOREM TAXES FOR THE FISCAL YEAR BEGINNING OCTOBER 1, 2019 AND ENDING SEPTEMBER 30, 2020, AND FOR

EACH YEAR THEREAFTER UNTIL OTHERWISE PROVIDED, AT THE RATE OF $0.62777 PER ONE HUNDRED DOLLARS

($100.00) ASSESSED VALUE ON ALL TAXABLE PROPERTY WITHIN THE CORPORATE LIMITS OF THE CITY OF BENBROOK,

TEXAS, AS OF JANUARY 1, 2019, TO PROVIDE REVENUES FOR THE PAYMENT OF CURRENT EXPENSES AND TO

PROVIDE AN INTEREST IN DEBT SERVICE FUNDS ON ALL OUTSTANDING DEBTS OF THE CITY; DIRECTING THE

ASSESSMENT THEREOF; PROVIDING FOR DUE AND DELINQUENT DATES TOGETHER WITH PENALTIES AND INTEREST

THEREON; PROVIDING FOR PLACE OF PAYMENT; PROVIDING FOR APPROVAL OF THE TAX ROLLS PRESENTED TO THE

CITY COUNCIL; PROVIDING FOR THE REPEAL OF INCONSISTENT ORDINANCES; PROVIDING FOR A SEVERABILITY

CLAUSE AND DECLARING AN EFFECTIVE DATE.

WHEREAS, the City Council of the City of Benbrook, Texas (hereinafter referred to as the "City") hereby finds that the tax for the fiscal year

beginning October 1, 2019, and ending September 30, 2020, hereinafter levied for current expenses of the City and the general

improvements of the City and its property must be levied to provide the revenue requirements of the budget for the ensuing year; and

WHEREAS, the City Council has approved by a separate ordinance adopted on the 19 day of September, 2019, the budget for the fiscal

th

year beginning October 1, 2019, and ending September 30, 2020; and

WHEREAS, all statutory and constitutional requirements concerning the levying and assessing of ad valorem taxes have been complied with.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF BENBROOK, TEXAS, THAT:

SECTION I

All of the above premises are found to be true and correct and are incorporated into the body of this ordinance as if copied in their entirety.

SECTION II

The ad valorem tax appraisal roll and effective tax rate information as presented by the assessor to the City Council for the tax year 2019,

be and is hereby, in all things, approved and adopted.

SECTION III

There is hereby levied and ordered to be assessed and collected for the fiscal year beginning October 1, 2019, and ending September 30,

2020 and for each fiscal year thereafter until it be otherwise provided by and ordained on all taxable property, real, personal and mixed,

254 | P a g e