Page 64 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 64

Section 2 Financial Analysis

Budget 101 Overview

BASIS OF ACCOUNTING & BUDGETING

The Town of Westlake utilizes the modified accrual basis of accounting and budgeting for

governmental funds; and full accrual for proprietary funds. The term "basis of

accounting/ budgeting" is used to describe the timing of recognition, that is, when the effects of

transactions or events should be recognized. This refers to the conversions for recognition of

costs and revenue in budget development and in establishing and reporting appropriations that

are the legal authority to spend or collect revenues.

The Town’ s accounting system is organized and operated on a fund basis. A fund is a group of

functions combined into a separate accounting entity having its own assets, liabilities, equity,

revenue and expenditures/ expenses.

The budget is fully reconciled to the accounting system at the beginning of the fiscal year, and

in preparing the CAFR at the end of the fiscal year. GAAP adjustments are made to reflect

balance sheet requirements and their effect on the budget. These include changes in

designations and recognition, via studies and analysis, of accrued liabilities.

Amounts needed for such long-term liabilities as future payoff of accumulated employee

vacation is budgeted as they budgeted as projections and once recognized are adjusted for

actual amounts.

In the Modified Accrual Basis,

revenues are recognized in the period when they became available and

measurable

expenditures are recognized when the liability is incurred

In the Accrual Basis,

revenues are recorded when earned

expenses when the liability is incurred

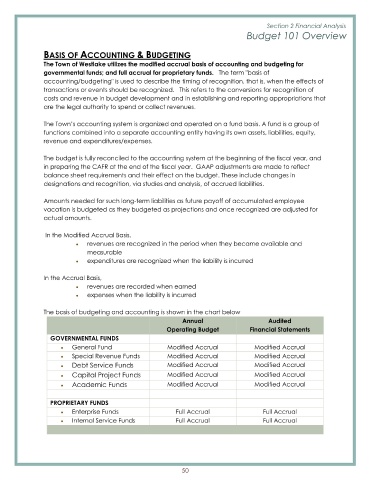

The basis of budgeting and accounting is shown in the chart below

Annual Audited

Operating Budget Financial Statements

GOVERNMENTAL FUNDS

General Fund Modified Accrual Modified Accrual

Special Revenue Funds Modified Accrual Modified Accrual

Debt Service Funds Modified Accrual Modified Accrual

Capital Project Funds Modified Accrual Modified Accrual

Academic Funds Modified Accrual Modified Accrual

PROPRIETARY FUNDS

Enterprise Funds Full Accrual Full Accrual

Internal Service Funds Full Accrual Full Accrual

50