Page 21 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 21

Section 1 Executive

Transmittal Financials

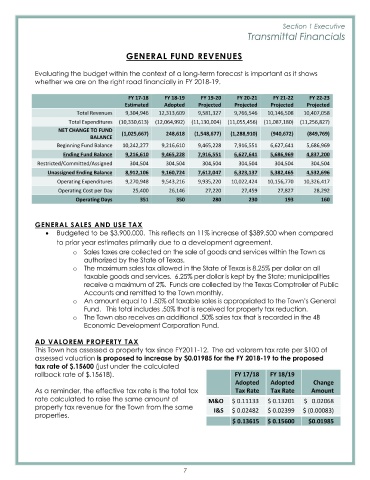

GENERAL FUND REVENUES

Evaluating the budget within the context of a long-term forecast is important as it shows

whether we are on the right road financially in FY 2018-19.

FY 17-18 FY 18-19 FY 19-20 FY 20-21 FY 21-22 FY 22-23

Estimated Adopted Projected Projected Projected Projected

Total Revenues 9,304,946 12,313,609 9,581,327 9,766,546 10,146,508 10,407,058

Total Expenditures ( 10,330,613) ( 12,064,992) ( 11,130,004) ( 11,055,456) ( 11,087,180) ( 11,256,827)

NET CHANGE TO FUND

1,025,667) 248,618 ( 1,548,677) ( 1,288,910) ( 940,672) ( 849,769)

BALANCE (

Beginning Fund Balance 10,242,277 9,216,610 9,465,228 7,916,551 6,627,641 5,686,969

Ending Fund Balance 9,216,610 9,465,228 7,916,551 6,627,641 5,686,969 4,837,200

Restricted/ Committed/ Assigned 304,504 304,504 304,504 304,504 304,504 304,504

Unassigned Ending Balance 8,912,106 9,160,724 7,612,047 6,323,137 5,382,465 4,532,696

Operating Expenditures 9,270,948 9,543,216 9,935,220 10,022,424 10,156,770 10,326,417

Operating Cost per Day 25,400 26,146 27,220 27,459 27,827 28,292

Operating Days 351 350 280 230 193 160

GENERAL SALES AND USE TAX

Budgeted to be $3,900,000. This reflects an 11% increase of $389,500 when compared

to prior year estimates primarily due to a development agreement.

o Sales taxes are collected on the sale of goods and services within the Town as

authorized by the State of Texas.

o The maximum sales tax allowed in the State of Texas is 8.25% per dollar on all

taxable goods and services. 6.25% per dollar is kept by the State; municipalities

receive a maximum of 2%. Funds are collected by the Texas Comptroller of Public

Accounts and remitted to the Town monthly.

o An amount equal to 1.50% of taxable sales is appropriated to the Town’ s General

Fund. This total includes . 50% that is received for property tax reduction.

o The Town also receives an additional .50% sales tax that is recorded in the 4B

Economic Development Corporation Fund.

AD VALOREM PROPERTY TAX

This Town has assessed a property tax since FY2011-12. The ad valorem tax rate per $100 of

assessed valuation is proposed to increase by $0.01985 for the FY 2018- 19 to the proposed

tax rate of $.15600 ( just under the calculated

rollback rate of $.15618). FY 17/ 18 FY 18/ 19

Adopted Adopted Change

As a reminder, the effective tax rate is the total tax Tax Rate Tax Rate Amount

rate calculated to raise the same amount of M&O $ 0.11133 $ 0.13201 $ 0.02068

property tax revenue for the Town from the same

I&S $ 0.02482 $ 0.02399 $ ( 0.00083)

properties.

0.13615 $ 0.15600 $ 0.01985

7