Page 236 - Saginaw FY19 Annual Budget

P. 236

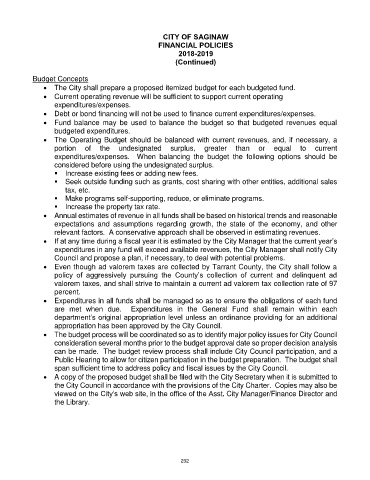

CITY OF SAGINAW

FINANCIAL POLICIES

2018-2019

(Continued)

Budget Concepts

The City shall prepare a proposed itemized budget for each budgeted fund.

Current operating revenue will be sufficient to support current operating

expenditures/expenses.

Debt or bond financing will not be used to finance current expenditures/expenses.

Fund balance may be used to balance the budget so that budgeted revenues equal

budgeted expenditures.

The Operating Budget should be balanced with current revenues, and, if necessary, a

portion of the undesignated surplus, greater than or equal to current

expenditures/expenses. When balancing the budget the following options should be

considered before using the undesignated surplus.

Increase existing fees or adding new fees.

Seek outside funding such as grants, cost sharing with other entities, additional sales

tax, etc.

Make programs self-supporting, reduce, or eliminate programs.

Increase the property tax rate.

Annual estimates of revenue in all funds shall be based on historical trends and reasonable

expectations and assumptions regarding growth, the state of the economy, and other

relevant factors. A conservative approach shall be observed in estimating revenues.

If at any time during a fiscal year it is estimated by the City Manager that the current year’s

expenditures in any fund will exceed available revenues, the City Manager shall notify City

Council and propose a plan, if necessary, to deal with potential problems.

Even though ad valorem taxes are collected by Tarrant County, the City shall follow a

policy of aggressively pursuing the County’s collection of current and delinquent ad

valorem taxes, and shall strive to maintain a current ad valorem tax collection rate of 97

percent.

Expenditures in all funds shall be managed so as to ensure the obligations of each fund

are met when due. Expenditures in the General Fund shall remain within each

department’s original appropriation level unless an ordinance providing for an additional

appropriation has been approved by the City Council.

The budget process will be coordinated so as to identify major policy issues for City Council

consideration several months prior to the budget approval date so proper decision analysis

can be made. The budget review process shall include City Council participation, and a

Public Hearing to allow for citizen participation in the budget preparation. The budget shall

span sufficient time to address policy and fiscal issues by the City Council.

A copy of the proposed budget shall be filed with the City Secretary when it is submitted to

the City Council in accordance with the provisions of the City Charter. Copies may also be

viewed on the City’s web site, in the office of the Asst. City Manager/Finance Director and

the Library.

232