Page 235 - Saginaw FY19 Annual Budget

P. 235

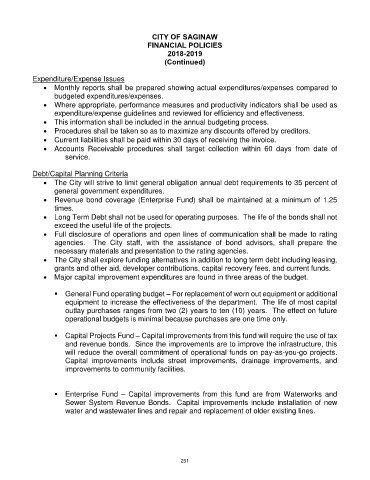

CITY OF SAGINAW

FINANCIAL POLICIES

2018-2019

(Continued)

Expenditure/Expense Issues

Monthly reports shall be prepared showing actual expenditures/expenses compared to

budgeted expenditures/expenses.

Where appropriate, performance measures and productivity indicators shall be used as

expenditure/expense guidelines and reviewed for efficiency and effectiveness.

This information shall be included in the annual budgeting process.

Procedures shall be taken so as to maximize any discounts offered by creditors.

Current liabilities shall be paid within 30 days of receiving the invoice.

Accounts Receivable procedures shall target collection within 60 days from date of

service.

Debt/Capital Planning Criteria

The City will strive to limit general obligation annual debt requirements to 35 percent of

general government expenditures.

Revenue bond coverage (Enterprise Fund) shall be maintained at a minimum of 1.25

times.

Long Term Debt shall not be used for operating purposes. The life of the bonds shall not

exceed the useful life of the projects.

Full disclosure of operations and open lines of communication shall be made to rating

agencies. The City staff, with the assistance of bond advisors, shall prepare the

necessary materials and presentation to the rating agencies.

The City shall explore funding alternatives in addition to long term debt including leasing,

grants and other aid, developer contributions, capital recovery fees, and current funds.

Major capital improvement expenditures are found in three areas of the budget.

General Fund operating budget – For replacement of worn out equipment or additional

equipment to increase the effectiveness of the department. The life of most capital

outlay purchases ranges from two (2) years to ten (10) years. The effect on future

operational budgets is minimal because purchases are one time only.

Capital Projects Fund – Capital improvements from this fund will require the use of tax

and revenue bonds. Since the improvements are to improve the infrastructure, this

will reduce the overall commitment of operational funds on pay-as-you-go projects.

Capital improvements include street improvements, drainage improvements, and

improvements to community facilities.

Enterprise Fund – Capital improvements from this fund are from Waterworks and

Sewer System Revenue Bonds. Capital improvements include installation of new

water and wastewater lines and repair and replacement of older existing lines.

231