Page 222 - Cover 3.psd

P. 222

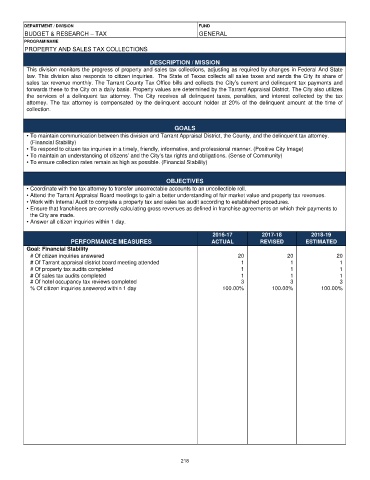

DEPARTMENT / DIVISION FUND

BUDGET & RESEARCH – TAX GENERAL

PROGRAM NAME

PROPERTY AND SALES TAX COLLECTIONS

DESCRIPTION / MISSION

This division monitors the progress of property and sales tax collections, adjusting as required by changes in Federal And State

law. This division also responds to citizen inquiries. The State of Texas collects all sales taxes and sends the City its share of

sales tax revenue monthly. The Tarrant County Tax Office bills and collects the City’s current and delinquent tax payments and

forwards these to the City on a daily basis. Property values are determined by the Tarrant Appraisal District. The City also utilizes

the services of a delinquent tax attorney. The City receives all delinquent taxes, penalties, and interest collected by the tax

attorney. The tax attorney is compensated by the delinquent account holder at 20% of the delinquent amount at the time of

collection.

GOALS

• To maintain communication between this division and Tarrant Appraisal District, the County, and the delinquent tax attorney.

(Financial Stability)

• To respond to citizen tax inquiries in a timely, friendly, informative, and professional manner. (Positive City Image)

• To maintain an understanding of citizens’ and the City’s tax rights and obligations. (Sense of Community)

• To ensure collection rates remain as high as possible. (Financial Stability)

OBJECTIVES

• Coordinate with the tax attorney to transfer uncorrectable accounts to an uncollectible roll.

• Attend the Tarrant Appraisal Board meetings to gain a better understanding of fair market value and property tax revenues.

• Work with Internal Audit to complete a property tax and sales tax audit according to established procedures.

• Ensure that franchisees are correctly calculating gross revenues as defined in franchise agreements on which their payments to

the City are made.

• Answer all citizen inquiries within 1 day.

2016-17 2017-18 2018-19

PERFORMANCE MEASURES ACTUAL REVISED ESTIMATED

Goal: Financial Stability

# Of citizen inquiries answered 20 20 20

# Of Tarrant appraisal district board meeting attended 1 1 1

# Of property tax audits completed 1 1 1

# Of sales tax audits completed 1 1 1

# Of hotel occupancy tax reviews completed 3 3 3

% Of citizen inquiries answered within 1 day 100.00% 100.00% 100.00%

218