Page 122 - FY 19 Budget Forecast 91218.xlsx

P. 122

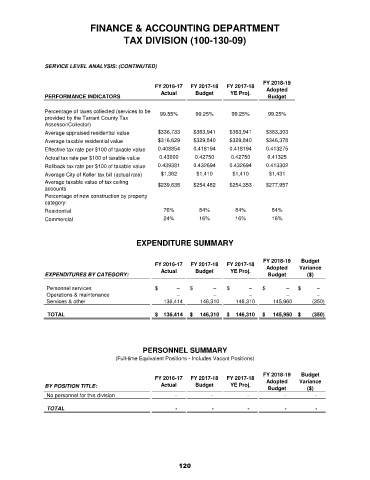

FINANCE & ACCOUNTING DEPARTMENT

TAX DIVISION (100-130-09)

SERVICE LEVEL ANALYSIS: (CONTINUTED)

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted

Actual Budget YE Proj.

PERFORMANCE INDICATORS Budget

Percentage of taxes collected (services to be 99.55% 99.25% 99.25% 99.25%

provided by the Tarrant County Tax

Assessor/Collector)

Average appraised residential value $336,733 $363,941 $363,941 $383,303

Average taxable residential value $316,629 $329,840 $329,840 $346,378

Effective tax rate per $100 of taxable value 0.408854 0.418194 0.418194 0.413275

Actual tax rate per $100 of taxable value 0.43000 0.42750 0.42750 0.41325

Rollback tax rate per $100 of taxable value 0.439381 0.432694 0.432694 0.413302

Average City of Keller tax bill (actual rate) $1,362 $1,410 $1,410 $1,431

Average taxable value of tax ceiling $239,638 $254,482 $254,353 $277,957

accounts

Percentage of new construction by property

category:

Residential 76% 84% 84% 84%

Commercial 24% 16% 16% 16%

EXPENDITURE SUMMARY

FY 2018-19 Budget

FY 2016-17 FY 2017-18 FY 2017-18

Actual Budget YE Proj. Adopted Variance

EXPENDITURES BY CATEGORY: Budget ($)

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance – – – – –

Services & other 136,414 146,310 146,310 145,960 (350)

TOTAL $ 136,414 $ 146,310 $ 146,310 $ 145,960 $ (350)

PERSONNEL SUMMARY

(Full-time Equivalent Positions - Includes Vacant Positions)

FY 2018-19 Budget

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Variance

BY POSITION TITLE: Actual Budget YE Proj. Budget ($)

No personnel for this division - - - - -

TOTAL - - - - -

120