Page 118 - FY 19 Budget Forecast 91218.xlsx

P. 118

FINANCE & ACCOUNTING DEPARTMENT

ADMINISTRATION DIVISION (100-130-01)

DEPARTMENT DESCRIPTION:

The Finance and Accounting Department maintains oversight responsibility for management of the City's assets. The

Director of Finance is responsible for oversight of purchasing, accounting, payroll, accounts receivable, accounts

payable, cash and investment management, capital financing, and customer service (utility billing) activities. The

department also provides accounting services for the Keller Development Corporation (KDC), the Keller Tax Increment

Reinvestment Zone (TIRZ), and the Keller Crime Control Prevention District (KCCPD).

DEPARTMENT/DIVISION GOALS:

1. Safeguard the City's assets by developing and/or complying with financial, investment and other related policies and

procedures, and proper and timely recording of accounting transactions.

2. Ensure the City's financial accountability and responsible use of resources.

3. Maintain effective cash and investment management in order to realize a competitive rate of return, while protecting

the City's safety of principal, in accordance with the City's Investment Policy and procedures.

4. Provide for the efficient and timely procurement of supplies, materials, equipment, and services for all City

operations by working closely with vendors and other governmental entities to ensure that both the proper quantity and

quality of materials and services are available.

5. Continue to strengthen internal control procedures by maintaining and updating formal financial management

policies.

DEPARTMENT/DIVISION OBJECTIVES:

1. Complete reporting requirements to continue receiving the "Certificate of Achievement for Excellence in Financial

Reporting" from the Government Finance Officers Association for the Comprehensive Annual Financial Report for the

30th consecutive year (FY1989 – FY2018).

2. Complete reporting requirements to continue to receive the "Distinguished Budget Presentation Award" from the

Government Finance Officers Association for the annual budget document for the 23rd consecutive year (FY1996 –

FY2019).

3. Maintain or strengthen the financial status of the City with outside sources, e.g. rating agencies, investors, and other

governmental agencies by providing accurate and timely financial information.

4. Continue applying for Transparency Stars from the State Comptroller’s office.

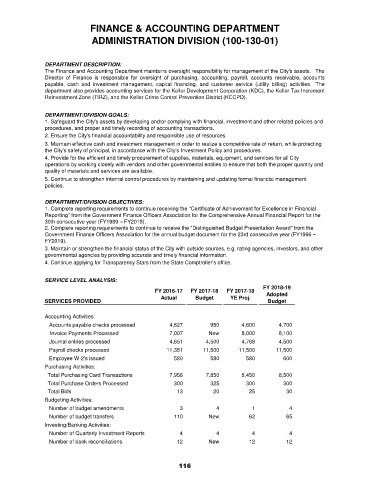

SERVICE LEVEL ANALYSIS:

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18

Actual Budget YE Proj. Adopted

SERVICES PROVIDED Budget

Accounting Activities:

Accounts payable checks processed 4,827 950 4,600 4,700

Invoice Payments Processed 7,007 New 8,000 8,100

Journal entries processed 4,651 4,500 4,768 4,500

Payroll checks processed 11,351 11,500 11,500 11,500

Employee W-2's issued 580 580 580 600

Purchasing Activities:

Total Purchasing Card Transactions 7,956 7,850 8,450 8,500

Total Purchase Orders Processed 300 325 300 300

Total Bids 13 20 25 30

Budgeting Activities:

Number of budget amendments 3 4 1 4

Number of budget transfers 110 New 62 65

Investing/Banking Activities:

Number of Quarterly Investment Reports 4 4 4 4

Number of bank reconciliations 12 New 12 12

116