Page 25 - Haltom City FY19 Annual Budget

P. 25

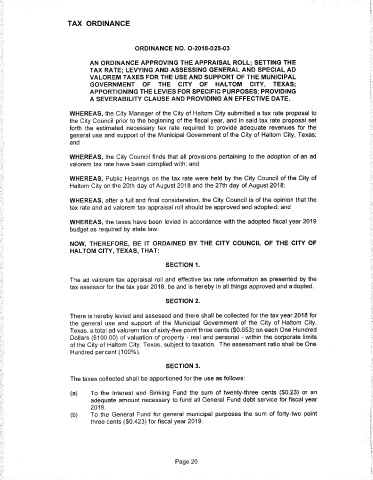

TAX ORDINANCE

ORDINANCE NO 0 2018 025 03

AN ORDINANCE APPROVING THE APPRAISAL ROLL SETTING THE

TAX RATE LEVYING AND ASSESSING GENERAL AND SPECIAL AD

VALOREM TAXES FOR THE USE AND SUPPORT OF THE MUNICIPAL

GOVERNMENT OF THE CITY OF HAL TOM CITY TEXAS

APPORTIONING THE LEVIES FOR SPECIFIC PURPOSES PROVIDING

A SEVERABILITY CLAUSE AND PROVIDING AN EFFECTIVE DATE

WHEREAS the City Manager of the City of Haltom City submitted a tax rate proposal to

the City Council prior to the beginning of the fiscal year and in said tax rate proposal set

forth the estimated necessary tax rate required to provide adequate revenues for the

general use and support of the Municipal Government of the City of Haltom City Texas

and

WHEREAS the City Council finds that all provisions pertaining to the adoption of an ad

valorem tax rate have been complied with and

WHEREAS Public Hearings on the tax rate were held by the City Council of the City of

Haltom City on the 20th day of August 2018 and the 27th day of August 2018

WHEREAS after a full and final consideration the City Council is of the opinion that the

tax rate and ad valorem tax appraisal roll should be approved and adopted and

WHEREAS the taxes have been levied in accordance with the adopted fiscal year 2019

budget as required by state law

NOW THEREFORE BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF

HALTOM CITY TEXAS THAT

SECTION 1

The ad valorem tax appraisal roll and effective tax rate information as presented by the

tax assessor for the tax year 2018 be and is hereby in all things approved and adopted

SECTION 2

There is hereby levied and assessed and there shall be collected for the tax year 2018 for

the general use and support of the Municipal Government of the City of Haltom City

Texas a total ad valorem tax of sixty five point three cents 0 653 on each One Hundred

Dollars 100 00 of valuation of property real and personal within the corporate limits

of the City of Haltom City Texas subject to taxation The assessment ratio shall be One

Hundred percent 100

SECTION 3

The taxes collected shall be apportioned for the use as follows

a To the Interest and Sinking Fund the sum of twenty three cents 0 23 or an

adequate amount necessary to fund all General Fund debt service for fiscal year

2019

b To the General Fund for general municipal purposes the sum of forty two point

423

three cents 0 for fiscal year 2019

Page 20