Page 105 - Haltom City FY19 Annual Budget

P. 105

HOTEL / MOTEL TAX FUND

Revenues for this fund come from the 7% Hotel/Motel Occupancy Tax levied on all hotels and

motels in the City. Funds are used for advertising and general promotion of the City and

historical preservation. The City also uses these funds to support the beautification program.

HOTEL/MOTEL TAX FUND

BUDGET SUMMARY

Actual Adopted Projected Adopted

FUND 14 FY2017 FY2018 FY 2018 FY2019

Fund Balance, Beginning $108,019 $93,305 $115,445 $106,104

Revenues

Hotel/Motel Tax Revenue 44,308 44,000 44,000 44,000

Interest Income 1,192 900 1,200 1,200

Total Revenues 45,500 44,900 45,200 45,200

Funds Available 153,519 138,205 160,645 151,304

Expenditures

Beautification Expenditures 18,424 19,060 17,910 19,060

Special Events - Overtime 19,005 24,111 24,111 24,237

Non-Departmental 645 12,520 12,520 12,520

Total Expenditures 38,074 55,691 54,541 55,817

Fund Balance, Ending $115,445 $82,514 $106,104 $95,487

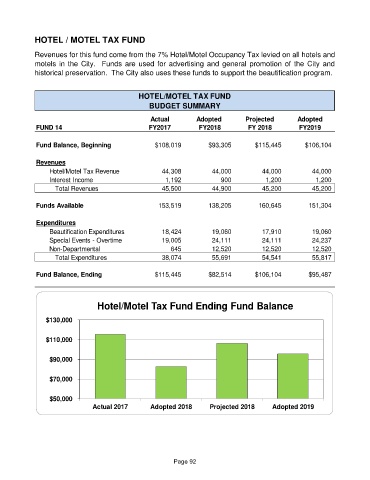

Hotel/Motel Tax Fund Ending Fund Balance

$130,000

$110,000

$90,000

$70,000

$50,000

Actual 2017 Adopted 2018 Projected 2018 Adopted 2019

Page 92