Page 10 - Grapevine FY19 Operating Budget

P. 10

Compensation (Fire and General employees) 1,500,000

Total $4,825,000

Although these costs are significant, the General Fund balances through the application of

conservative revenue assumptions and holding the tax rate constant at 0.289 per $100 of

valuation.

Although, sales tax revenues remain strong, growth is not exceeding the pace of

expenditures. Since 2016, there has been a reduction in sales tax growth, but it still remains

positive. An analysis of neighboring cities shows a steady decline in sales tax revenue

from 8% growth to 3% growth by the end of FY17. The FY19 projection assumes a 1%

growth rate above the year-end projection with a positive adjustment for projects coming

online in FY19 that is supported by TXP economic studies. All factors considered, the FY19

sales tax estimate is $28.9 million for the next year.

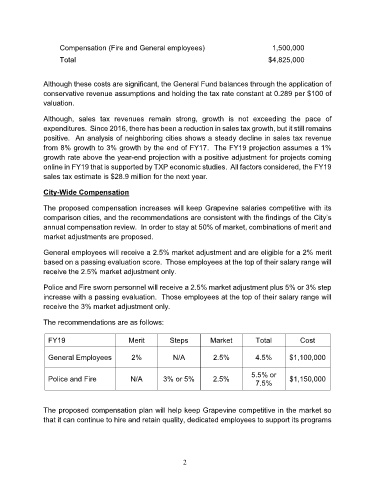

City-Wide Compensation

The proposed compensation increases will keep Grapevine salaries competitive with its

comparison cities, and the recommendations are consistent with the findings of the City’s

annual compensation review. In order to stay at 50% of market, combinations of merit and

market adjustments are proposed.

General employees will receive a 2.5% market adjustment and are eligible for a 2% merit

based on a passing evaluation score. Those employees at the top of their salary range will

receive the 2.5% market adjustment only.

Police and Fire sworn personnel will receive a 2.5% market adjustment plus 5% or 3% step

increase with a passing evaluation. Those employees at the top of their salary range will

receive the 3% market adjustment only.

The recommendations are as follows:

FY19 Merit Steps Market Total Cost

General Employees 2% N/A 2.5% 4.5% $1,100,000

5.5% or

Police and Fire N/A 3% or 5% 2.5% $1,150,000

7.5%

The proposed compensation plan will help keep Grapevine competitive in the market so

that it can continue to hire and retain quality, dedicated employees to support its programs

2