Page 571 - Fort Worth City Budget 2019

P. 571

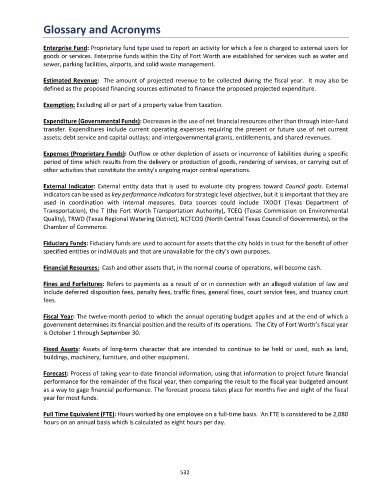

Glossary and Acronyms

Enterprise Fund: Proprietary fund type used to report an activity for which a fee is charged to external users for

goods or services. Enterprise funds within the City of Fort Worth are established for services such as water and

sewer, parking facilities, airports, and solid waste management.

Estimated Revenue: The amount of projected revenue to be collected during the fiscal year. It may also be

defined as the proposed financing sources estimated to finance the proposed projected expenditure.

Exemption: Excluding all or part of a property value from taxation.

Expenditure (Governmental Funds): Decreases in the use of net financial resources other than through inter-fund

transfer. Expenditures include current operating expenses requiring the present or future use of net current

assets; debt service and capital outlays; and intergovernmental grants, entitlements, and shared revenues.

Expenses (Proprietary Funds): Outflow or other depletion of assets or incurrence of liabilities during a specific

period of time which results from the delivery or production of goods, rendering of services, or carrying out of

other activities that constitute the entity's ongoing major central operations.

External Indicator: External entity data that is used to evaluate city progress toward Council goals. External

indicators can be used as key performance indicators for strategic level objectives, but it is important that they are

used in coordination with internal measures. Data sources could include TXDOT (Texas Department of

Transportation), the T (the Fort Worth Transportation Authority), TCEQ (Texas Commission on Environmental

Quality), TRWD (Texas Regional Watering District), NCTCOG (North Central Texas Council of Governments), or the

Chamber of Commerce.

Fiduciary Funds: Fiduciary funds are used to account for assets that the city holds in trust for the benefit of other

specified entities or individuals and that are unavailable for the city’s own purposes.

Financial Resources: Cash and other assets that, in the normal course of operations, will become cash.

Fines and Forfeitures: Refers to payments as a result of or in connection with an alleged violation of law and

include deferred disposition fees, penalty fees, traffic fines, general fines, court service fees, and truancy court

fees.

Fiscal Year: The twelve-month period to which the annual operating budget applies and at the end of which a

government determines its financial position and the results of its operations. The City of Fort Worth’s fiscal year

is October 1 through September 30.

Fixed Assets: Assets of long-term character that are intended to continue to be held or used, such as land,

buildings, machinery, furniture, and other equipment.

Forecast: Process of taking year-to-date financial information, using that information to project future financial

performance for the remainder of the fiscal year, then comparing the result to the fiscal year budgeted amount

as a way to gage financial performance. The forecast process takes place for months five and eight of the fiscal

year for most funds.

Full Time Equivalent (FTE): Hours worked by one employee on a full-time basis. An FTE is considered to be 2,080

hours on an annual basis which is calculated as eight hours per day.

532