Page 568 - Fort Worth City Budget 2019

P. 568

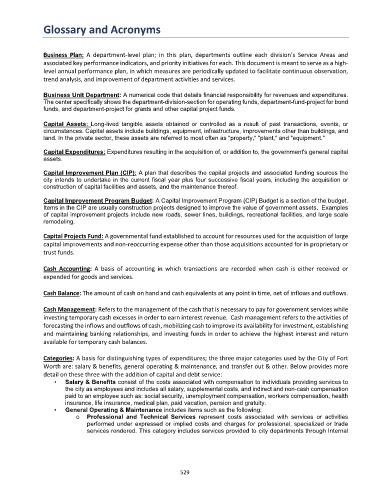

Glossary and Acronyms

Business Plan: A department-level plan; in this plan, departments outline each division’s Service Areas and

associated key performance indicators, and priority initiatives for each. This document is meant to serve as a high-

level annual performance plan, in which measures are periodically updated to facilitate continuous observation,

trend analysis, and improvement of department activities and services.

Business Unit Department: A numerical code that details financial responsibility for revenues and expenditures.

The center specifically shows the department-division-section for operating funds, department-fund-project for bond

funds, and department-project for grants and other capital project funds.

Capital Assets: Long-lived tangible assets obtained or controlled as a result of past transactions, events, or

circumstances. Capital assets include buildings, equipment, infrastructure, improvements other than buildings, and

land. In the private sector, these assets are referred to most often as "property," "plant," and "equipment."

Capital Expenditures: Expenditures resulting in the acquisition of, or addition to, the government's general capital

assets.

Capital Improvement Plan (CIP): A plan that describes the capital projects and associated funding sources the

city intends to undertake in the current fiscal year plus four successive fiscal years, including the acquisition or

construction of capital facilities and assets, and the maintenance thereof.

Capital Improvement Program Budget: A Capital Improvement Program (CIP) Budget is a section of the budget.

Items in the CIP are usually construction projects designed to improve the value of government assets. Examples

of capital improvement projects include new roads, sewer lines, buildings, recreational facilities, and large scale

remodeling.

Capital Projects Fund: A governmental fund established to account for resources used for the acquisition of large

capital improvements and non-reoccurring expense other than those acquisitions accounted for in proprietary or

trust funds.

Cash Accounting: A basis of accounting in which transactions are recorded when cash is either received or

expended for goods and services.

Cash Balance: The amount of cash on hand and cash equivalents at any point in time, net of inflows and outflows.

Cash Management: Refers to the management of the cash that is necessary to pay for government services while

investing temporary cash excesses in order to earn interest revenue. Cash management refers to the activities of

forecasting the inflows and outflows of cash, mobilizing cash to improve its availability for investment, establishing

and maintaining banking relationships, and investing funds in order to achieve the highest interest and return

available for temporary cash balances.

Categories: A basis for distinguishing types of expenditures; the three major categories used by the City of Fort

Worth are: salary & benefits, general operating & maintenance, and transfer out & other. Below provides more

detail on these three with the addition of capital and debt service:

• Salary & Benefits consist of the costs associated with compensation to individuals providing services to

the city as employees and includes all salary, supplemental costs, and indirect and non-cash compensation

paid to an employee such as: social security, unemployment compensation, workers compensation, health

insurance, life insurance, medical plan, paid vacation, pension and gratuity.

• General Operating & Maintenance includes items such as the following:

o Professional and Technical Services represent costs associated with services or activities

performed under expressed or implied costs and charges for professional, specialized or trade

services rendered. This category includes services provided to city departments through Internal

529