Page 340 - Fort Worth City Budget 2019

P. 340

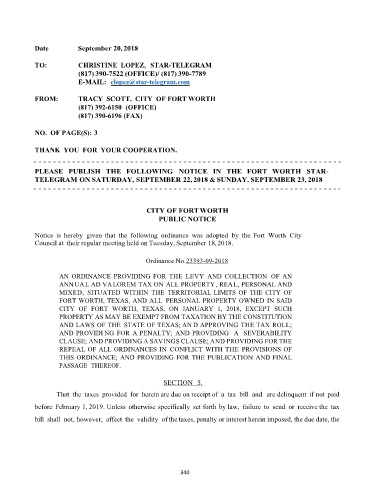

Date September 20, 2018

TO: CHRISTINE LOPEZ, STAR-TELEGRAM

(817) 390-7522 (OFFICE)/ (817) 390-7789

E-MAIL: clopez@star-telegram.com

FROM: TRACY SCOTT, CITY OF FORT WORTH

(817) 392-6150 (OFFICE)

(817) 390-6196 (FAX)

NO. OF PAGE(S): 3

THANK YOU FOR YOUR COOPERATION.

PLEASE PUBLISH THE FOLLOWING NOTICE IN THE FORT WORTH STAR-

TELEGRAM ON SATURDAY, SEPTEMBER 22, 2018 & SUNDAY, SEPTEMBER 23, 2018

CITY OF FORT WORTH

PUBLIC NOTICE

Notice is hereby given that the following ordinance was adopted by the Fort Worth City

Council at their regular meeting held on Tuesday, September 18, 2018.

Ordinance No. 23393-09-2018

AN ORDINANCE PROVIDING FOR THE LEVY AND COLLECTION OF AN

ANN UA L AD VA LOREM TAX ON ALL PROPERTY , REA L, PERSONAL AND

MIXED, SITUATED WITHIN THE TERRITORIAL LIMITS OF THE CITY OF

FORT WORTH, TEXAS, AND ALL PERSONAL PROPERTY OWNED IN SAID

CITY OF FORT WORTH, TEXAS, ON JANUARY 1, 2018, EXCEPT SUCH

PROPERTY AS MAY BE EXEMPT FROM TAXATION BY THE CONSTITUTION

AND LAWS OF THE STATE OF TEXAS; AN D APPROVING THE TAX ROLL;

AND PROVIDI NG FOR A PENALTY; AND PROVIDING A SEVERABILITY

CLAUSE; AND PROVI DING A SAV INGS CLAUSE; AND PROVIDING FOR THE

REPEAL OF ALL ORDINANCES IN CONFLICT WITH THE PROVISIONS OF

THIS ORDINANCE; AND PROVIDING FOR THE PUBLICATION AND FINAL

PASSAGE THEREOF.

SECTION 5.

That the taxes provided for herein are due on receipt of a tax bill and are delinquent if not paid

before February 1, 2019. Unless otherwise specifically set forth by law, failure to send or receive the tax

bill shall not, however, affect the validity of the taxes, penalty or interest herein imposed, the due date, the

340