Page 339 - Fort Worth City Budget 2019

P. 339

SECTION 12.

That such taxes, penalty and interest shall be and become a lien upon the property on which

the taxes are levied, as prescribed by the Charter of the City of Fort Worth, Texas, and the laws of the

State of Texas, and such lien shall be and is hereby made a paramount, first and superior lien to all other

liens whatsoever on the property on which said taxes are levied.

SECTION 13.

That staff is directed to notify the assessor of the tax rate adopted herein, which the assessor shall use

in calculating the tax imposed on each property included on the City's appraisal roll, which tax amounts the

assessor shall enter in the appraisal roll and submit to the City for approval, all in accordance with Texas

Property Tax Code Section 26.09, and that the appraisal roll with amounts so calculated, entered and submitted

is hereby approved.

SECTION 14.

That should any part, portion, section or part of a section of this ordinance be declared invalid or

inoperative or void for any reason by a court of competent jurisdiction, such decision, opinion or judgment

shall in no way affect the remaining portions, parts, sections or parts of sections of this ordinance, which

provision shall be, remain and continue to be in full force and effect.

SECTION 15.

That all ordinances for which provisions have heretofore been made are hereby expressly repealed if in

conflict with the provisions of this ordinance.

SECTION 16.

That this ordinance shall take effect and be in full force and effect from and after the date of its passage

and publication as required by the Charter of the City of Fort Worth, and it is so ordained.

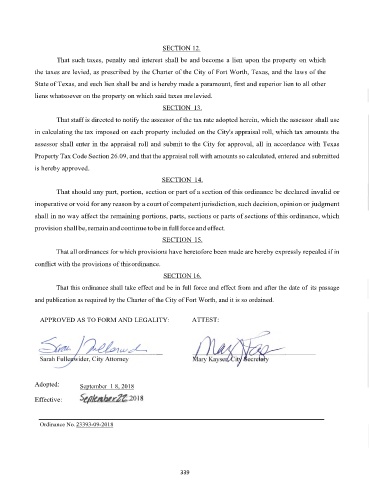

APPROVED AS TO FORM AND LEGALITY: ATTEST:

Adopted: September 1 8, 2018

Effective:

Ordinance No. 23393-09-2018

339