Page 257 - Fort Worth City Budget 2019

P. 257

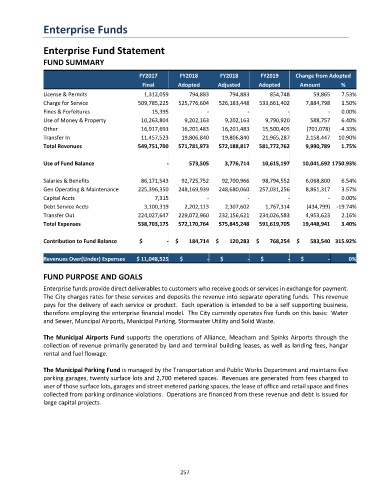

Enterprise Funds

Enterprise Fund Statement

FUND SUMMARY

FY2017 FY2018 FY2018 FY2019 Change from Adopted

Final Adopted Adjusted Adopted Amount %

License & Permits 1,312,059 794,883 794,883 854,748 59,865 7.53%

Charge for Service 509,785,225 525,776,604 526,183,448 533,661,402 7,884,798 1.50%

Fines & Forfeitures 15,395 - - - - 0.00%

Use of Money & Property 10,263,804 9,202,163 9,202,163 9,790,920 588,757 6.40%

Other 16,917,693 16,201,483 16,201,483 15,500,405 (701,078) -4.33%

Transfer In 11,457,523 19,806,840 19,806,840 21,965,287 2,158,447 10.90%

Total Revenues 549,751,700 571,781,973 572,188,817 581,772,762 9,990,789 1.75%

Use of Fund Balance - 573,505 3,776,714 10,615,197 10,041,692 1750.93%

Salaries & Benefits 86,171,543 92,725,752 92,700,966 98,794,552 6,068,800 6.54%

Gen Operating & Maintenance 225,396,350 248,169,939 248,680,060 257,031,256 8,861,317 3.57%

Capital Accts 7,315 - - - - 0.00%

Debt Service Accts 3,100,319 2,202,113 2,307,602 1,767,314 (434,799) -19.74%

Transfer Out 224,027,647 229,072,960 232,156,621 234,026,583 4,953,623 2.16%

Total Expenses 538,703,175 572,170,764 575,845,248 591,619,705 19,448,941 3.40%

Contribution to Fund Balance $ - $ 184,714 $ 120,283 $ 768,254 $ 583,540 315.92%

Revenues Over(Under) Expenses $ 11,048,525 $ - $ - $ - $ - 0%

FUND PURPOSE AND GOALS

Enterprise funds provide direct deliverables to customers who receive goods or services in exchange for payment.

The City charges rates for these services and deposits the revenue into separate operating funds. This revenue

pays for the delivery of each service or product. Each operation is intended to be a self supporting business,

therefore employing the enterprise financial model. The City currently operates five funds on this basis: Water

and Sewer, Muncipal Airports, Municipal Parking, Stormwater Utility and Solid Waste.

The Municipal Airports Fund supports the operations of Alliance, Meacham and Spinks Airports through the

collection of revenue primarily generated by land and terminal building leases, as well as landing fees, hangar

rental and fuel flowage.

The Municipal Parking Fund is managed by the Transportation and Public Works Department and maintains five

parking garages, twenty surface lots and 2,700 metered spaces. Revenues are generated from fees charged to

user of those surface lots, garages and street metered parking spaces, the lease of office and retail space and fines

collected from parking ordinance violations. Operations are financed from these revenue and debt is issued for

large capital projects.

257