Page 33 - Microsoft Word - Budget FY 19

P. 33

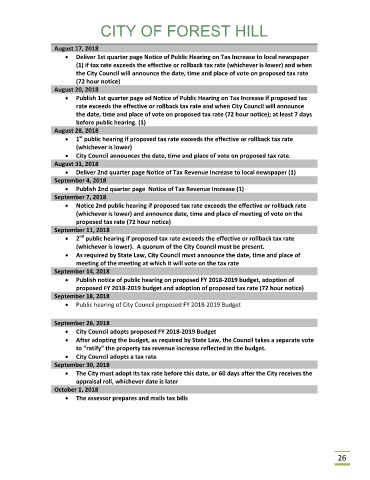

CITY OF FOREST HILL

August 17, 2018

Deliver 1st quarter page Notice of Public Hearing on Tax Increase to local newspaper

(1) if tax rate exceeds the effective or rollback tax rate (whichever is lower) and when

the City Council will announce the date, time and place of vote on proposed tax rate

(72 hour notice)

August 20, 2018

Publish 1st quarter page ad Notice of Public Hearing on Tax Increase if proposed tax

rate exceeds the effective or rollback tax rate and when City Council will announce

the date, time and place of vote on proposed tax rate (72 hour notice); at least 7 days

before public hearing. (1)

August 28, 2018

st

1 public hearing if proposed tax rate exceeds the effective or rollback tax rate

(whichever is lower)

City Council announces the date, time and place of vote on proposed tax rate.

August 31, 2018

Deliver 2nd quarter page Notice of Tax Revenue Increase to local newspaper (1)

September 4, 2018

Publish 2nd quarter page Notice of Tax Revenue Increase (1)

September 7, 2018

Notice 2nd public hearing if proposed tax rate exceeds the effective or rollback rate

(whichever is lower) and announce date, time and place of meeting of vote on the

proposed tax rate (72 hour notice)

September 11, 2018

nd

2 public hearing if proposed tax rate exceeds the effective or rollback tax rate

(whichever is lower). A quorum of the City Council must be present.

As required by State Law, City Council must announce the date, time and place of

meeting of the meeting at which it will vote on the tax rate

September 14, 2018

Publish notice of public hearing on proposed FY 2018‐2019 budget, adoption of

proposed FY 2018‐2019 budget and adoption of proposed tax rate (72 hour notice)

September 18, 2018

Public hearing of City Council proposed FY 2018‐2019 Budget

September 26, 2018

City Council adopts proposed FY 2018‐2019 Budget

After adopting the budget, as required by State Law, the Council takes a separate vote

to “ratify” the property tax revenue increase reflected in the budget.

City Council adopts a tax rate

September 30, 2018

The City must adopt its tax rate before this date, or 60 days after the City receives the

appraisal roll, whichever date is later

October 1, 2018

The assessor prepares and mails tax bills

26