Page 251 - Colleyville FY19 Budget

P. 251

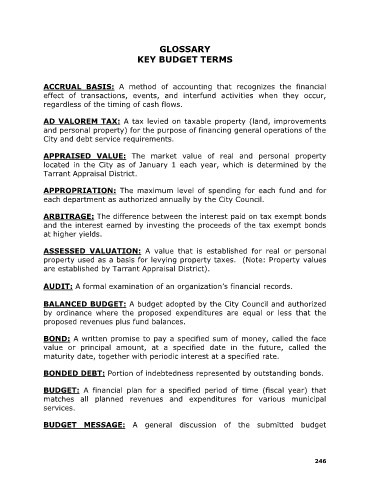

GLOSSARY

KEY BUDGET TERMS

ACCRUAL BASIS: A method of accounting that recognizes the financial

effect of transactions, events, and interfund activities when they occur,

regardless of the timing of cash flows.

AD VALOREM TAX: A tax levied on taxable property (land, improvements

and personal property) for the purpose of financing general operations of the

City and debt service requirements.

APPRAISED VALUE: The market value of real and personal property

located in the City as of January 1 each year, which is determined by the

Tarrant Appraisal District.

APPROPRIATION: The maximum level of spending for each fund and for

each department as authorized annually by the City Council.

ARBITRAGE: The difference between the interest paid on tax exempt bonds

and the interest earned by investing the proceeds of the tax exempt bonds

at higher yields.

ASSESSED VALUATION: A value that is established for real or personal

property used as a basis for levying property taxes. (Note: Property values

are established by Tarrant Appraisal District).

AUDIT: A formal examination of an organization’s financial records.

BALANCED BUDGET: A budget adopted by the City Council and authorized

by ordinance where the proposed expenditures are equal or less that the

proposed revenues plus fund balances.

BOND: A written promise to pay a specified sum of money, called the face

value or principal amount, at a specified date in the future, called the

maturity date, together with periodic interest at a specified rate.

BONDED DEBT: Portion of indebtedness represented by outstanding bonds.

BUDGET: A financial plan for a specified period of time (fiscal year) that

matches all planned revenues and expenditures for various municipal

services.

BUDGET MESSAGE: A general discussion of the submitted budget

246