Page 81 - Honorable Mayor and Members of the City Council

P. 81

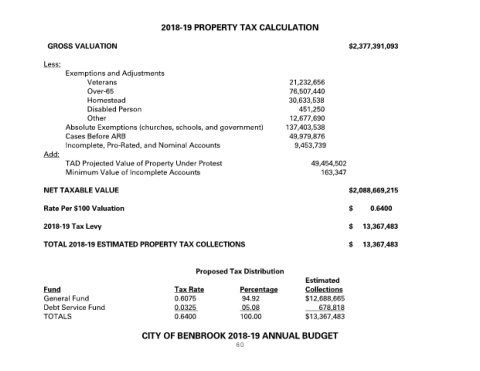

2018-19 PROPERTY TAX CALCULATION

GROSS VALUATION $2,377,391,093

Less:

Exemptions and Adjustments

Veterans 21,232,656

Over-65 76,507,440

Homestead 30,633,538

Disabled Person 451,250

Other 12,677,690

Absolute Exemptions (churches, schools, and government) 137,403,538

Cases Before ARB 49,979,876

Incomplete, Pro-Rated, and Nominal Accounts 9,453,739

Add:

TAD Projected Value of Property Under Protest 49,454,502

Minimum Value of Incomplete Accounts 163,347

NET TAXABLE VALUE $2,088,669,215

Rate Per $100 Valuation $ 0.6400

2018-19 Tax Levy $ 13,367,483

TOTAL 2018-19 ESTIMATED PROPERTY TAX COLLECTIONS $ 13,367,483

Proposed Tax Distribution

Estimated

Fund Tax Rate Percentage Collections

General Fund 0.6075 94.92 $12,688,665

Debt Service Fund 0.0325 05.08 678,818

TOTALS 0.6400 100.00 $13,367,483

CITY OF BENBROOK 2018-19 ANNUAL BUDGET

80