Page 146 - Honorable Mayor and Members of the City Council

P. 146

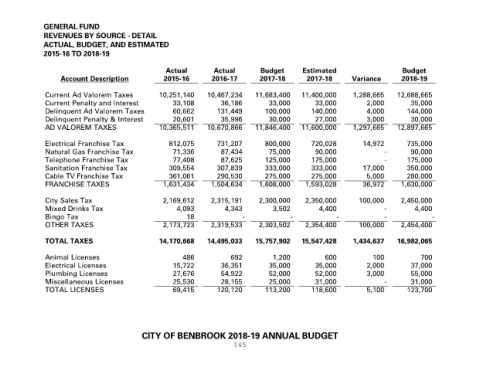

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

2015-16 TO 2018-19

Actual Actual Budget Estimated Budget

Account Description 2015-16 2016-17 2017-18 2017-18 Variance 2018-19

Current Ad Valorem Taxes 10,251,140 10,467,234 11,683,400 11,400,000 1,288,665 12,688,665

Current Penalty and Interest 33,108 36,186 33,000 33,000 2,000 35,000

Delinquent Ad Valorem Taxes 60,662 131,449 100,000 140,000 4,000 144,000

Delinquent Penalty & Interest 20,601 35,996 30,000 27,000 3,000 30,000

AD VALOREM TAXES 10,365,511 10,670,866 11,846,400 11,600,000 1,297,665 12,897,665

Electrical Franchise Tax 812,075 731,207 800,000 720,028 14,972 735,000

Natural Gas Franchise Tax 71,336 87,434 75,000 90,000 - 90,000

Telephone Franchise Tax 77,408 87,625 125,000 175,000 - 175,000

Sanitation Franchise Tax 309,554 307,839 333,000 333,000 17,000 350,000

Cable TV Franchise Tax 361,061 290,530 275,000 275,000 5,000 280,000

FRANCHISE TAXES 1,631,434 1,504,634 1,608,000 1,593,028 36,972 1,630,000

City Sales Tax 2,169,612 2,315,191 2,300,000 2,350,000 100,000 2,450,000

Mixed Drinks Tax 4,093 4,343 3,502 4,400 - 4,400

Bingo Tax 18 - - - - -

OTHER TAXES 2,173,723 2,319,533 2,303,502 2,354,400 100,000 2,454,400

TOTAL TAXES 14,170,668 14,495,033 15,757,902 15,547,428 1,434,637 16,982,065

Animal Licenses 486 692 1,200 600 100 700

Electrical Licenses 15,722 36,351 35,000 35,000 2,000 37,000

Plumbing Licenses 27,676 54,922 52,000 52,000 3,000 55,000

Miscellaneous Licenses 25,530 28,155 25,000 31,000 - 31,000

TOTAL LICENSES 69,415 120,120 113,200 118,600 5,100 123,700

CITY OF BENBROOK 2018-19 ANNUAL BUDGET

145