Page 76 - Azle City Budget 2019

P. 76

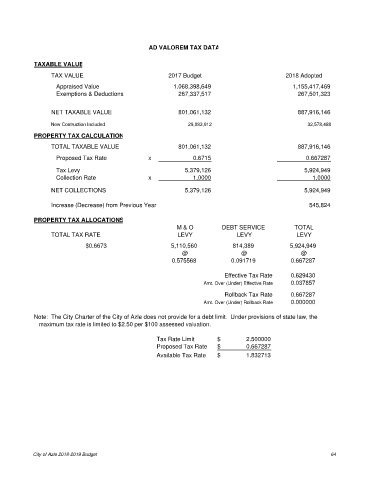

AD VALOREM TAX DATA

TAXABLE VALUE

TAX VALUE 2017 Budget 2018 Adopted

Appraised Value 1,068,398,649 1,155,417,469

Exemptions & Deductions 267,337,517 267,501,323

NET TAXABLE VALUE 801,061,132 887,916,146

New Contruction Included 29,083,912 32,578,488

PROPERTY TAX CALCULATION

TOTAL TAXABLE VALUE 801,061,132 887,916,146

Proposed Tax Rate x 0.6715 0.667287

Tax Levy 5,379,126 5,924,949

Collection Rate x 1.0000 1.0000

NET COLLECTIONS 5,379,126 5,924,949

Increase (Decrease) from Previous Year 545,824

PROPERTY TAX ALLOCATIONS

M & O DEBT SERVICE TOTAL

TOTAL TAX RATE LEVY LEVY LEVY

$0.6673 5,110,560 814,389 5,924,949

@ @ @

0.575568 0.091719 0.667287

Effective Tax Rate 0.629430

Amt. Over (Under) Effective Rate 0.037857

Rollback Tax Rate 0.667287

Amt. Over (Under) Rollback Rate 0.000000

Note: The City Charter of the City of Azle does not provide for a debt limit. Under provisions of state law, the

maximum tax rate is limited to $2.50 per $100 assessed valuation.

Tax Rate Limit $ 2.500000

Proposed Tax Rate $ 0.667287

Available Tax Rate $ 1.832713

City of Azle 2018-2019 Budget 64