Page 26 - Azle City Budget 2019

P. 26

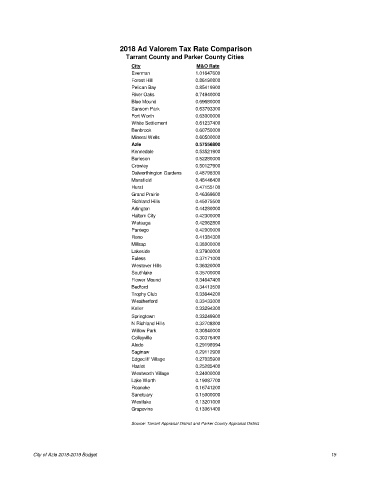

2018 Ad Valorem Tax Rate Comparison

Tarrant County and Parker County Cities

City M&O Rate

Everman 1.01647600

Forest Hill 0.86190800

Pelican Bay 0.85419900

River Oaks 0.74940000

Blue Mound 0.69680000

Sansom Park 0.63793300

Fort Worth 0.63000000

White Settlement 0.61237400

Benbrook 0.60750000

Mineral Wells 0.60500000

Azle 0.57556800

Kennedale 0.53521900

Burleson 0.52280000

Crowley 0.50127900

Dalworthington Gardens 0.48798300

Mansfield 0.48446400

Hurst 0.47155100

Grand Prairie 0.46369600

Richland Hills 0.45075500

Arlington 0.44280000

Haltom City 0.42300000

Watauga 0.42062800

Pantego 0.42000000

Reno 0.41384300

Millsap 0.38000000

Lakeside 0.37900000

Euless 0.37171000

Westover Hills 0.36320000

Southlake 0.35700000

Flower Mound 0.34647400

Bedford 0.34413500

Trophy Club 0.33644200

Weatherford 0.33433000

Keller 0.33294300

Springtown 0.33249900

N Richland Hills 0.32708800

Willow Park 0.30840000

Colleyville 0.30376400

Aledo 0.29198994

Saginaw 0.29112900

Edgecliff Village 0.27035900

Haslet 0.25285400

Westworth Village 0.24000000

Lake Worth 0.19087700

Roanoke 0.16741200

Sanctuary 0.15000000

Westlake 0.13201000

Grapevine 0.13061400

Source: Tarrant Appraisal District and Parker County Appraisal District

City of Azle 2018-2019 Budget 15