Page 69 - FY 19 Budget Forecast 91218.xlsx

P. 69

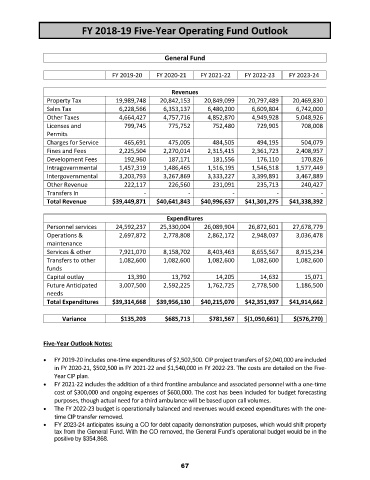

FY 2018‐19 Five‐Year Operating Fund Outlook

General Fund

FY 2019‐20 FY 2020‐21 FY 2021‐22 FY 2022‐23 FY 2023‐24

Revenues

Property Tax 19,989,748 20,842,153 20,849,099 20,797,489 20,469,830

Sales Tax 6,228,566 6,353,137 6,480,200 6,609,804 6,742,000

Other Taxes 4,664,427 4,757,716 4,852,870 4,949,928 5,048,926

Licenses and 799,745 775,752 752,480 729,905 708,008

Permits

Charges for Service 465,691 475,005 484,505 494,195 504,079

Fines and Fees 2,225,504 2,270,014 2,315,415 2,361,723 2,408,957

Development Fees 192,960 187,171 181,556 176,110 170,826

Intragovernmental 1,457,319 1,486,465 1,516,195 1,546,518 1,577,449

Intergovernmental 3,203,793 3,267,869 3,333,227 3,399,891 3,467,889

Other Revenue 222,117 226,560 231,091 235,713 240,427

Transfers In ‐ ‐ ‐ ‐ ‐

Total Revenue $39,449,871 $40,641,843 $40,996,637 $41,301,275 $41,338,392

Expenditures

Personnel services 24,592,237 25,330,004 26,089,904 26,872,601 27,678,779

Operations & 2,697,872 2,778,808 2,862,172 2,948,037 3,036,478

maintenance

Services & other 7,921,070 8,158,702 8,403,463 8,655,567 8,915,234

Transfers to other 1,082,600 1,082,600 1,082,600 1,082,600 1,082,600

funds

Capital outlay 13,390 13,792 14,205 14,632 15,071

Future Anticipated 3,007,500 2,592,225 1,762,725 2,778,500 1,186,500

needs

Total Expenditures $39,314,668 $39,956,130 $40,215,070 $42,351,937 $41,914,662

Variance $135,203 $685,713 $781,567 $(1,050,661) $(576,270)

Five‐Year Outlook Notes:

FY 2019‐20 includes one‐time expenditures of $2,502,500. CIP project transfers of $2,040,000 are included

in FY 2020‐21, $502,500 in FY 2021‐22 and $1,540,000 in FY 2022‐23. The costs are detailed on the Five‐

Year CIP plan.

FY 2021‐22 includes the addition of a third frontline ambulance and associated personnel with a one‐time

cost of $300,000 and ongoing expenses of $600,000. The cost has been included for budget forecasting

purposes, though actual need for a third ambulance will be based upon call volumes.

The FY 2022‐23 budget is operationally balanced and revenues would exceed expenditures with the one‐

time CIP transfer removed.

FY 2023-24 anticipates issuing a CO for debt capacity demonstration purposes, which would shift property

tax from the General Fund. With the CO removed, the General Fund’s operational budget would be in the

positive by $354,868.

67