Page 331 - FY 19 Budget Forecast 91218.xlsx

P. 331

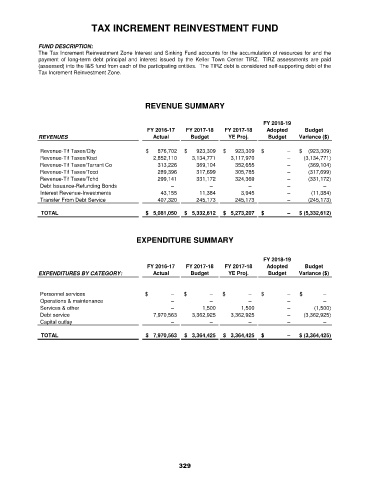

TAX INCREMENT REINVESTMENT FUND

FUND DESCRIPTION:

The Tax Increment Reinvestment Zone Interest and Sinking Fund accounts for the accumulation of resources for and the

payment of long-term debt principal and interest issued by the Keller Town Center TIRZ. TIRZ assessments are paid

(assessed) into the I&S fund from each of the participating entities. The TIRZ debt is considered self-supporting debt of the

Tax Increment Reinvestment Zone.

REVENUE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Revenue-Tif Taxes/City $ 876,702 $ 923,309 $ 923,309 $ – $ (923,309)

Revenue-Tif Taxes/Kisd 2,852,110 3,134,771 3,117,970 – (3,134,771)

Revenue-Tif Taxes/Tarrant Co 313,226 369,104 352,655 – (369,104)

Revenue-Tif Taxes/Tccd 289,396 317,699 305,785 – (317,699)

Revenue-Tif Taxes/Tchd 299,141 331,172 324,369 – (331,172)

Debt Issuance-Refunding Bonds – – – – –

Interest Revenue-Investments 43,155 11,384 3,945 – (11,384)

Transfer From Debt Service 407,320 245,173 245,173 – (245,173)

TOTAL $ 5,081,050 $ 5,332,612 $ 5,273,207 $ – $ (5,332,612)

EXPENDITURE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance – – – – –

Services & other – 1,500 1,500 – (1,500)

Debt service 7,970,563 3,362,925 3,362,925 – (3,362,925)

Capital outlay – – – – –

TOTAL $ 7,970,563 $ 3,364,425 $ 3,364,425 $ – $ (3,364,425)

329