Page 3 - WestworthVillageFY26AdoptedBudget

P. 3

3

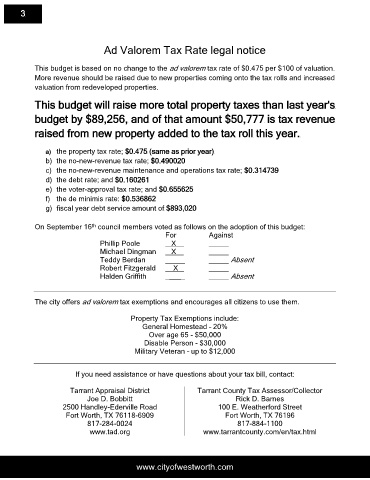

Ad Valorem Tax Rate legal notice

This budget is based on no change to the ad valorem tax rate of $0.475 per $100 of valuation.

More revenue should be raised due to new properties coming onto the tax rolls and increased

valuation from redeveloped properties.

This budget will raise more total property taxes than last year's

budget by $89,256, and of that amount $50,777 is tax revenue

raised from new property added to the tax roll this year.

a) the property tax rate; $0.475 (same as prior year)

b) the no-new-revenue tax rate; $0.490020

c) the no-new-revenue maintenance and operations tax rate; $0.314739

d) the debt rate; and $0.160261

e) the voter-approval tax rate; and $0.655625

f) the de minimis rate: $0.536862

g) fiscal year debt service amount of $893,020

On September 16 council members voted as follows on the adoption of this budget:

th

For Against

Phillip Poole _ X _ _____

Michael Dingman _ X __ __

Teddy Berdan _ _ _____ Absent

Robert Fitzgerald _ X _ _____

Halden Griffith _ _ _____ Absent

The city offers ad valorem tax exemptions and encourages all citizens to use them.

Property Tax Exemptions include:

General Homestead – 20%

Over age 65 - $50,000

Disable Person - $30,000

Military Veteran – up to $12,000

If you need assistance or have questions about your tax bill, contact:

Tarrant Appraisal District Tarrant County Tax Assessor/Collector

Joe D. Bobbitt Rick D. Barnes

2500 Handley-Ederville Road 100 E. Weatherford Street

Fort Worth, TX 76118-6909 Fort Worth, TX 76196

817-284-0024 817-884-1100

www.tad.org www.tarrantcounty.com/en/tax.html

www.cityofwestworth.com