Page 139 - CITY OF WATAUGA, TEXAS ANNUAL BUDGET PORTRAIT

P. 139

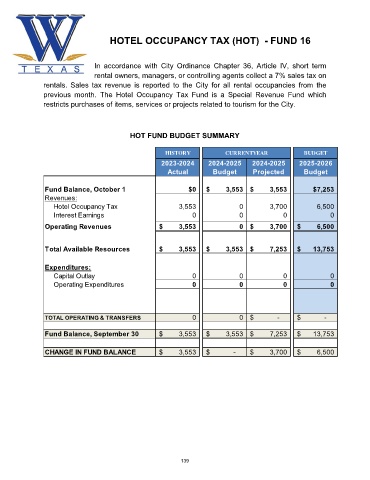

HOTEL OCCUPANCY TAX (HOT) - FUND 16

In accordance with City Ordinance Chapter 36, Article IV, short term

rental owners, managers, or controlling agents collect a 7% sales tax on

rentals. Sales tax revenue is reported to the City for all rental occupancies from the

previous month. The Hotel Occupancy Tax Fund is a Special Revenue Fund which

restricts purchases of items, services or projects related to tourism for the City.

HOT FUND BUDGET SUMMARY

HISTORY CURRENTYEAR BUDGET

2023-2024 2024-2025 2024-2025 2025-2026

Actual Budget Projected Budget

Fund Balance, October 1 $0 $ 3,553 $ 3,553 $7,253

Revenues:

Hotel Occupancy Tax 3,553 0 3,700 6,500

Interest Earnings 0 0 0 0

Operating Revenues $ 3,553 0 $ 3,700 $ 6,500

Total Available Resources $ 3,553 $ 3,553 $ 7,253 $ 13,753

Expenditures:

Capital Outlay 0 0 0 0

Operating Expenditures 0 0 0 0

TOTAL OPERATING & TRANSFERS 0 0 $ - $ -

Fund Balance, September 30 $ 3,553 $ 3,553 $ 7,253 $ 13,753

CHANGE IN FUND BALANCE $ 3,553 $ - $ 3,700 $ 6,500

139