Page 151 - TownofTrophyClubOrd202534BudgetAmendmentFY26

P. 151

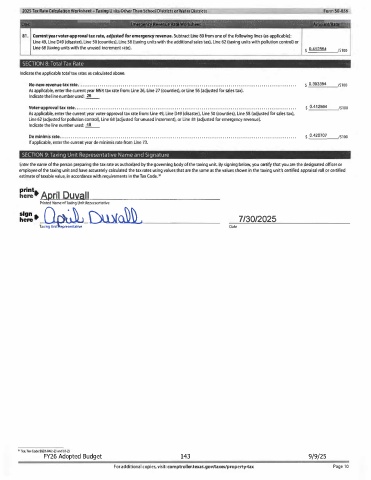

2025 Tu Ra� ukulation Worllshi!! rt- loin Units Other Than School Di�trlctso, Wal« Dist clS -- FormS0-8S6

Une � -�- -- ,_ Rate Worksheet ,.. -· 4::, Amount/Rate �

041. Disaster Line 41 (D41 ): Current year voter-approval M&O rate for taxing unit affected by disaster declaration. If the taxing unit is

located in an area declared a disaster area and at least one person is granted an exemption under Tax Code Section 11.35 for property located

in the taxing unit, the governing body may direct the person calculating the voter-approval tax rate to calculate In the manner provided for a

special taxing unit. The taxing unit shall continue to calculate the voter-approval tax rate in this manner until the earlier of:

1 l the first year in which total taxable value on the certified appraisal roll exceeds the total taxable value of

the tax year in which the disaster occurred; or

2) the third tax year after the tax year in which the disaster occurred.

If the taxing unit qualifies under this scenario, multiply line 40C by 1.08. If the taxing unit does not qualify, do not complete

27

Disaster Line 41 (line D41). $ 0.00000 / 100

$

42. Total current year debt to be paid with property taxes and additional sales tax revenue. Debt means the interest and principal that will

be paid on debts that:

(1) are paid by property taxes;

(2) are secured by property taxes;

(3) are scheduled for payment over a period longer than one year; and

(4) are not classified in the taxing unit's budget as M&O expenses.

A. Debt also includes contractual payments to other taxing units that have incurred debts on behalf of this taxing unit, if those debts

meet the four conditions above. Include only amounts that will be paid from property tax revenue. Do not include appraisal district

budget payments. If the governing body of a taxing unit authorized or agreed to authorize a bond, warrant, certificate of obligation,

or other evidence of indebtedness on or after Sept. 1, 2021, verify if it meets the amended definition of debt before including it here."

Enter debt amount .................................................................................... $ 3,083,782

8. Subtract unencumbered fund amount used to reduce total debt. ...................................... -$ 0

c. Subtract certified amount spent from sales tax to reduce debt (enter zero if none) .................... -$ 0

D. Subtract amount paid from other resources ............................................................ -$0

E. Adjusted debt. Subtract B, C and D from A. $ 3,083,782

43. Certified prior year excess debt collections. Enter the amount certified by the collector. 29 $ 269,658

44. Adjusted current year debt. Subtract Line 43 from line 42E. $ 2,814,124

45. Current year anticipated collection rate.

A. Enter the current year anticipated collection rate certified by the collector. '° .............................. 100.00 %

B. Enter the prior year actual collection rate ...................................... .......................... 99.22 %

C. Enter the 2023 actual collection rate . .................................................................. 99.70 %

.

o. Enter the 2022 actual collection rate .................................................................... 100.07 %

E. If the anticipated collection rate in A is lower than actual collection rates in B, C and D, enter the lowest

collection rate from B, C and D. If the anticipated rate in A is higher than at least one of the rates in the

prior three years, enter the rate from A. Note that the rate can be greater than 100%. 31 100.00 %

46. Current year debt adjusted for collections. Divide line 44 by Line 45E. $ 2,814,124

47. Current year total taxable value. Enter the amount on Line 21 of the No-New-Revenue Tax Rate Worksheet. $ 2,729,507,360

48. Current year debt rate. Divide Line 46 by Line 47 and multiply by S 100. $ 0.103100 / 100

$

49. Current year voter-approval M&o rate plus current year debt rate. Add Lines 41 and 48. $ 0.412864 / 100

$

049. Disaster Line 49 (D49): Current year voter-approval tax rate for taxing unit affected by disaster declaration. Complete this line if the

taxing unit calculated the voter-approval tax rate in the manner provided for a special taxing unit on line D41.

Add Line D41 and 48. $ 0.00 0000 / $ 100

'' Tex. Tax Code §26.042(1)

•Tex.Tax Code §26.012(n

"Ttx. Tax Code §26.012(10) and 26.04(b)

"Tex. Tax Code §26.04(b)

"Tex. Tax Code §§26.04(h), (11-1) and (h-2)

FY26 Adopted Budget 139 9/9/25

For additional copies, visit: comptroller.texas.gov/taxes/property-tax Page6