Page 145 - TownofTrophyClubOrd202534BudgetAmendmentFY26

P. 145

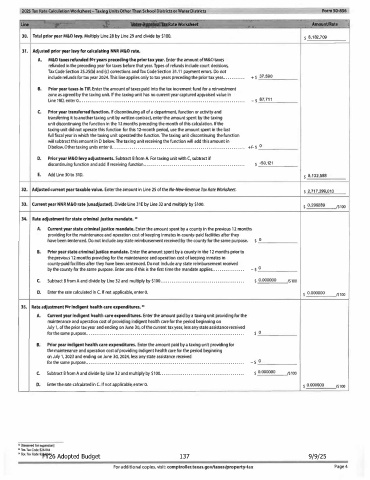

2025 Tax Rate Calculation Notice

Taxing Unit Name: __ T_o_w_n_o _f _T _ro .... p_h_y_C_lu_b __

Attached are the following documents:

No New Revenue and Voter Approval Tax Rate Worksheets

Notice of Tax Rates (required to be posted on taxing unit website)

Approving Rates: Section 8 on worksheet shows the following rates

No New Revenue Rate$ 0.393354

Voter Approval Rate$ 0.412864

Di Minimis Rate (if applicable) $ 0.420707

Please review these documents carefully and notify our office of any changes that need to be made. If any

changes are made, our office will send out new documents including the revisions. Once you are satisfied that

the calculation is correct, please sign this document stating that you approve the calculation worksheet that is

attached to this document.

Proposed M&O $ 0.309764 (Maintenance & Operation Rate)

Proposed l&S $ 0.103100 (Interest & Sinking or Debt Rate)

(proposed /&S rate must match line 48 on worksheet)

Proposed Total Rate$ 0.4 12864

As a representative of Town of Trophy Club , I approve the Tax Rate Calculation and have provided the

proposed tax rate for the taxing entity listed above.

April Duvall

Printed name

7/30/2025

Sign Date

FY26 Adopted Budget 133 9/9/25