Page 49 - CityofSouthlakeFY26AdoptedBudget

P. 49

operating expenditures, with the optimum goal of

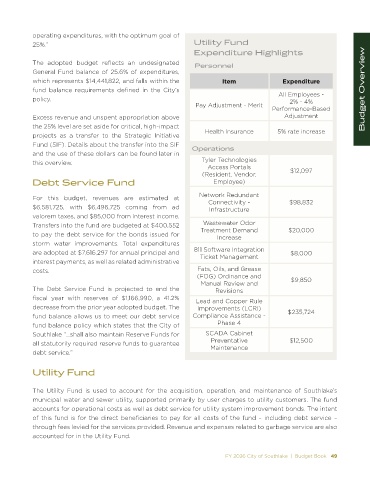

25%.” Utility Fund

Expenditure Highlights

The adopted budget reflects an undesignated Personnel

General Fund balance of 25.6% of expenditures,

which represents $14,441,822, and falls within the Item Expenditure

fund balance requirements defined in the City’s All Employees - Budget Overview

policy. 2% - 4%

Pay Adjustment - Merit

Performance-Based

Excess revenue and unspent appropriation above Adjustment

the 25% level are set aside for critical, high-impact

projects as a transfer to the Strategic Initiative Health Insurance 5% rate increase

Fund (SIF). Details about the transfer into the SIF Operations

and the use of these dollars can be found later in

this overview. Tyler Technologies

Access Portals

(Resident, Vendor, $12,097

Debt Service Fund Employee)

For this budget, revenues are estimated at Network Redundant $98,832

Connectivity -

$6,581,725, with $6,496,725 coming from ad Infrastructure

valorem taxes, and $85,000 from interest income.

Transfers into the fund are budgeted at $400,552 Wastewater Odor

to pay the debt service for the bonds issued for Treatment Demand $20,000

Increase

storm water improvements. Total expenditures

are adopted at $7,616,297 for annual principal and 811 Software Integration $8,000

Ticket Management

interest payments, as well as related administrative

costs. Fats, Oils, and Grease

(FOG) Ordinance and $9,850

Manual Review and

The Debt Service Fund is projected to end the Revisions

fiscal year with reserves of $1,166,990, a 41.2% Lead and Copper Rule

decrease from the prior year adopted budget. The Improvements (LCRI)

fund balance allows us to meet our debt service Compliance Assistance - $235,724

fund balance policy which states that the City of Phase 4

Southlake “…shall also maintain Reserve Funds for SCADA Cabinet

Preventative

all statutorily required reserve funds to guarantee Maintenance $12,500

debt service.”

Utility Fund

The Utility Fund is used to account for the acquisition, operation, and maintenance of Southlake’s

municipal water and sewer utility, supported primarily by user charges to utility customers. The fund

accounts for operational costs as well as debt service for utility system improvement bonds. The intent

of this fund is for the direct beneficiaries to pay for all costs of the fund – including debt service –

through fees levied for the services provided. Revenue and expenses related to garbage service are also

accounted for in the Utility Fund.

FY 2026 City of Southlake | Budget Book 49