Page 396 - CityofSouthlakeFY26AdoptedBudget

P. 396

Frequently Asked Questions

Taxation

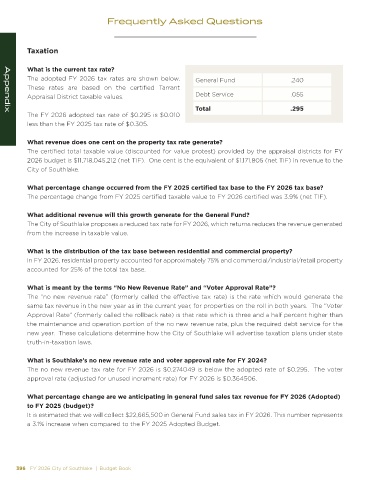

What is the current tax rate?

The adopted FY 2026 tax rates are shown below. General Fund .240

These rates are based on the certified Tarrant

Appraisal District taxable values. Debt Service .055

Total .295

The FY 2026 adopted tax rate of $0.295 is $0.010

Appendix

less than the FY 2025 tax rate of $0.305.

What revenue does one cent on the property tax rate generate?

The certified total taxable value (discounted for value protest) provided by the appraisal districts for FY

2026 budget is $11,718,045,212 (net TIF). One cent is the equivalent of $1,171,805 (net TIF) in revenue to the

City of Southlake.

What percentage change occurred from the FY 2025 certified tax base to the FY 2026 tax base?

The percentage change from FY 2025 certified taxable value to FY 2026 certified was 3.9% (net TIF).

What additional revenue will this growth generate for the General Fund?

The City of Southlake proposes a reduced tax rate for FY 2026, which returns reduces the revenue generated

from the increase in taxable value.

What is the distribution of the tax base between residential and commercial property?

In FY 2026, residential property accounted for approximately 75% and commercial/industrial/retail property

accounted for 25% of the total tax base.

What is meant by the terms “No New Revenue Rate” and “Voter Approval Rate”?

The “no new revenue rate” (formerly called the effective tax rate) is the rate which would generate the

same tax revenue in the new year as in the current year, for properties on the roll in both years. The “Voter

Approval Rate” (formerly called the rollback rate) is that rate which is three and a half percent higher than

the maintenance and operation portion of the no new revenue rate, plus the required debt service for the

new year. These calculations determine how the City of Southlake will advertise taxation plans under state

truth-in-taxation laws.

What is Southlake’s no new revenue rate and voter approval rate for FY 2024?

The no new revenue tax rate for FY 2026 is $0.274049 is below the adopted rate of $0.295. The voter

approval rate (adjusted for unused increment rate) for FY 2026 is $0.364506.

What percentage change are we anticipating in general fund sales tax revenue for FY 2026 (Adopted)

to FY 2025 (budget)?

It is estimated that we will collect $22,665,500 in General Fund sales tax in FY 2026. This number represents

a 3.1% increase when compared to the FY 2025 Adopted Budget.

396 FY 2026 City of Southlake | Budget Book