Page 345 - CityofSouthlakeFY26AdoptedBudget

P. 345

Commercial Vehicle Enforcement Fund

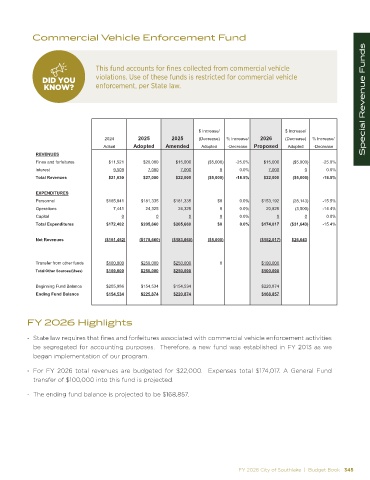

This fund accounts for fines collected from commercial vehicle

SPECIAL REVENUE FUND

DID YOU violations. Use of these funds is restricted for commercial vehicle

KNOW? enforcement, per State law.

Commercial Vehicle Enforcement

2026 Proposed and 2025 Revised Budget Special Revenue Funds

$ Increase/ $ Increase/

2024 2025 2025 (Decrease) % Increase/ 2026 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

REVENUES

Fines and forfeitures $11,521 $20,000 $15,000 ($5,000) -25.0% $15,000 ($5,000) -25.0%

Interest 9,509 7,000 7,000 0 0.0% 7,000 0 0.0%

Total Revenues $21,030 $27,000 $22,000 ($5,000) -18.5% $22,000 ($5,000) -18.5%

EXPENDITURES

Personnel $165,041 $181,335 $181,335 $0 0.0% $153,192 (28,143) -15.5%

Operations 7,441 24,325 24,325 0 0.0% 20,825 (3,500) -14.4%

Capital 0 0 0 0 0.0% 0 0 0.0%

Total Expenditures $172,482 $205,660 $205,660 $0 0.0% $174,017 ($31,643) -15.4%

Net Revenues ($151,452) ($178,660) ($183,660) ($5,000) ($152,017) $26,643

Transfer from other funds $100,000 $250,000 $250,000 0 $100,000

Total Other Sources/(Uses) $100,000 $250,000 $250,000 $100,000

Beginning Fund Balance $205,986 $154,534 $154,534 $220,874

Ending Fund Balance $154,534 $225,874 $220,874 $168,857

FY 2026 Highlights

- State law requires that fines and forfeitures associated with commercial vehicle enforcement activities

be segregated for accounting purposes. Therefore, a new fund was established in FY 2013 as we

began implementation of our program.

- For FY 2026 total revenues are budgeted for $22,000. Expenses total $174,017. A General Fund

transfer of $100,000 into this fund is projected.

- The ending fund balance is projected to be $168,857.

FY 2026 City of Southlake | Budget Book 345