Page 31 - CityofSouthlakeFY26AdoptedBudget

P. 31

Figure 7

Comparison of property values since FY 2016

(assessed and taxable)

^^ ^^ s >h d y > s >h Ύ

Ψϭϳ͕ϬϬϬ

Ψϭϱ͕ϰϳϴ Budget Overview

Ψϭϰ͕ϵϭϭ

Ψϭϱ͕ϬϬϬ

Ψϭϯ͕ϵϳϱ

Ψϭϯ͕ϬϬϬ ΨϭϮ͕ϭϳϳ

s >h d/KE /E D/>>/KE^ K& Ψ Ψϭϭ͕ϬϬϬ Ψϴ͕Ϯϲϵ Ψϴ͕ϳϰϯ Ψϵ͕ϴϭϬ ΨϭϬ͕ϱϮϲ ΨϭϬ͕ϳϭϰ Ψϭϭ͕ϭϯϴ ΨϭϬ͕ϱϲϱ Ψϭϭ͕Ϯϳϱ Ψϭϭ͕ϳϭϴ

Ψϵ͕ϬϬϬ

Ψϳ͕ϬϬϬ Ψϳ͕ϯϮϯ Ψϳ͕ϳϳϬ Ψϳ͕ϳϲϵ Ψϴ͕ϮϮϭ Ψϵ͕Ϭϲϱ

Ψϳ͕Ϯϴϳ

Ψϲ͕ϯϲϵ Ψϲ͕ϲϲϮ

Ψϱ͕ϬϬϬ Ψϱ͕ϳϴϱ

Ψϯ͕ϬϬϬ

ϮϬϭϲ ϮϬϭϳ ϮϬϭϴ ϮϬϭϵ ϮϬϮϬ ϮϬϮϭ ϮϬϮϮ ϮϬϮϯ ϮϬϮϰ ϮϬϮϱ ϮϬϮϲ

*Net TIRZ value

Ad Valorem (Property Tax) Revenues

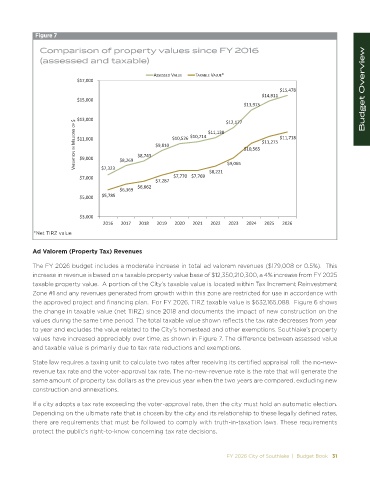

The FY 2026 budget includes a moderate increase in total ad valorem revenues ($179,008 or 0.5%). This

increase in revenue is based on a taxable property value base of $12,350,210,300, a 4% increase from FY 2025

taxable property value. A portion of the City’s taxable value is located within Tax Increment Reinvestment

Zone #1 and any revenues generated from growth within this zone are restricted for use in accordance with

the approved project and financing plan. For FY 2026, TIRZ taxable value is $632,165,088. Figure 6 shows

the change in taxable value (net TIRZ) since 2018 and documents the impact of new construction on the

values during the same time period. The total taxable value shown reflects the tax rate decreases from year

to year and excludes the value related to the City’s homestead and other exemptions. Southlake’s property

values have increased appreciably over time, as shown in Figure 7. The difference between assessed value

and taxable value is primarily due to tax rate reductions and exemptions.

State law requires a taxing unit to calculate two rates after receiving its certified appraisal roll: the no-new-

revenue tax rate and the voter-approval tax rate. The no-new-revenue rate is the rate that will generate the

same amount of property tax dollars as the previous year when the two years are compared, excluding new

construction and annexations.

If a city adopts a tax rate exceeding the voter-approval rate, then the city must hold an automatic election.

Depending on the ultimate rate that is chosen by the city and its relationship to these legally defined rates,

there are requirements that must be followed to comply with truth-in-taxation laws. These requirements

protect the public’s right-to-know concerning tax rate decisions.

FY 2026 City of Southlake | Budget Book 31