Page 45 - CityofSansomParkFY26AdoptedBudget

P. 45

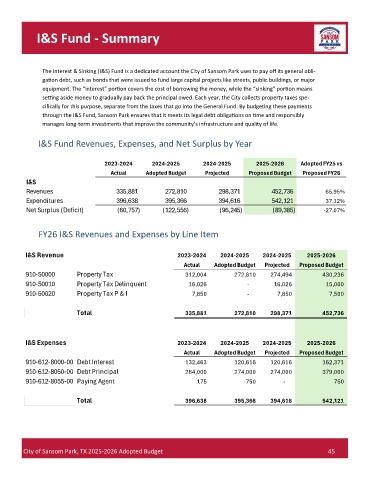

I&S Fund - Summary

The Interest & Sinking (I&S) Fund is a dedicated account the City of Sansom Park uses to pay off its general obli-

gation debt, such as bonds that were issued to fund large capital projects like streets, public buildings, or major

equipment. The “interest” portion covers the cost of borrowing the money, while the “sinking” portion means

setting aside money to gradually pay back the principal owed. Each year, the City collects property taxes spe-

cifically for this purpose, separate from the taxes that go into the General Fund. By budgeting these payments

through the I&S Fund, Sansom Park ensures that it meets its legal debt obligations on time and responsibly

manages long-term investments that improve the community’s infrastructure and quality of life.

I&S Fund Revenues, Expenses, and Net Surplus by Year

2023-2024 2024-2025 2024-2025 2025-2026 Adopted FY25 vs

Actual Adopted Budget Projected Proposed Budget Proposed FY26

I&S

Revenues 335,881 272,810 298,371 452,736 65.95%

Expenditures 396,638 395,366 394,616 542,121 37.12%

Net Surplus (Deficit) (60,757) (122,556) (96,245) (89,385) -27.07%

FY26 I&S Revenues and Expenses by Line Item

I&S Revenue 2023-2024 2024-2025 2024-2025 2025-2026

Actual Adopted Budget Projected Proposed Budget

910-50000 Property Tax 312,004 272,810 274,494 430,236

910-50010 Property Tax Delinquent 16,026 - 16,026 15,000

910-50020 Property Tax P & I 7,850 - 7,850 7,500

Total 335,881 272,810 298,371 452,736

I&S Expenses 2023-2024 2024-2025 2024-2025 2025-2026

Actual Adopted Budget Projected Proposed Budget

910-612-8000-00 Debt Interest 132,463 120,616 120,616 162,371

910-612-8050-00 Debt Principal 264,000 274,000 274,000 379,000

910-612-8055-00 Paying Agent 175 750 - 750

Total 396,638 395,366 394,616 542,121

City of Sansom Park, TX 2025-2026 Adopted Budget 45