Page 7 - CityofLakeWorthFY26AdoptedBudget

P. 7

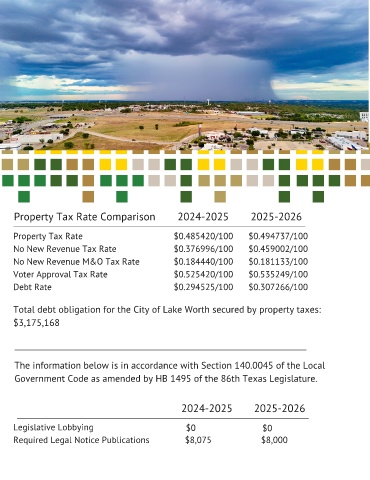

Property Tax Rate Comparison 2024-2025 2025-2026

Property Tax Rate $0.485420/100 $0.494737/100

No New Revenue Tax Rate $0.376996/100 $0.459002/100

No New Revenue M&O Tax Rate $0.184440/100 $0.181133/100

Voter Approval Tax Rate $0.525420/100 $0.535249/100

Debt Rate $0.294525/100 $0.307266/100

Total debt obligation for the City of Lake Worth secured by property taxes:

$3,175,168

The information below is in accordance with Section 140.0045 of the Local

Government Code as amended by HB 1495 of the 86th Texas Legislature.

2024-2025 2025-2026

Legislative Lobbying $0 $0

Required Legal Notice Publications $8,075 $8,000