Page 38 - CityofLakeWorthFY26AdoptedBudget

P. 38

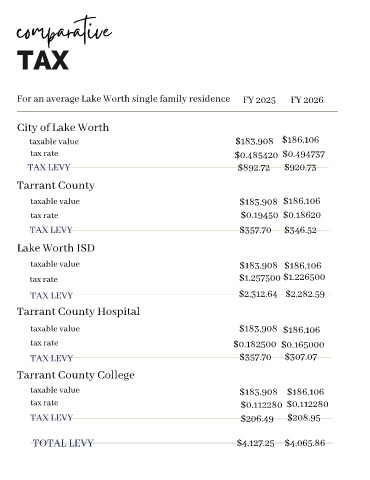

comparative

TAX

For an average Lake Worth single family residence FY 2025 FY 2026

City of Lake Worth

taxable value $183,908 $186,106

tax rate $0.485420 $0.494737

TAX LEVY $892.72 $920.73

Tarrant County

taxable value $183,908 $186,106

tax rate $0.19450 $0.18620

TAX LEVY $357.70 $346.52

Lake Worth ISD

taxable value $183,908 $186,106

tax rate $1.257500 $1.226500

TAX LEVY $2,312.64 $2,282.59

Tarrant County Hospital

taxable value $183,908 $186,106

tax rate $0.182500 $0.165000

TAX LEVY $357.70 $307.07

Tarrant County College

taxable value $183,908 $186,106

tax rate $0.112280 $0.112280

TAX LEVY $206.49 $208.95

TOTAL LEVY $4,127.25 $4,065.86