Page 4 - CityofKennedaleFY26AdoptedBudget

P. 4

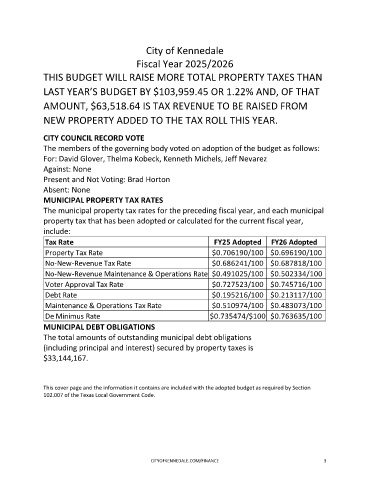

City of Kennedale

Fiscal Year 2025/2026

THIS BUDGET WILL RAISE MORE TOTAL PROPERTY TAXES THAN

LAST YEAR’S BUDGET BY $103,959.45 OR 1.22% AND, OF THAT

AMOUNT, $63,518.64 IS TAX REVENUE TO BE RAISED FROM

NEW PROPERTY ADDED TO THE TAX ROLL THIS YEAR.

CITY COUNCIL RECORD VOTE

The members of the governing body voted on adoption of the budget as follows:

For: David Glover, Thelma Kobeck, Kenneth Michels, Jeff Nevarez

Against: None

Present and Not Voting: Brad Horton

Absent: None

MUNICIPAL PROPERTY TAX RATES

The municipal property tax rates for the preceding fiscal year, and each municipal

property tax that has been adopted or calculated for the current fiscal year,

include:

Tax Rate FY25 Adopted FY26 Adopted

Property Tax Rate $0.706190/100 $0.696190/100

No-New-Revenue Tax Rate $0.686241/100 $0.687818/100

No-New-Revenue Maintenance & Operations Rate $0.491025/100 $0.502334/100

Voter Approval Tax Rate $0.727523/100 $0.745716/100

Debt Rate $0.195216/100 $0.213117/100

Maintenance & Operations Tax Rate $0.510974/100 $0.483073/100

De Minimus Rate $0.735474/$100 $0.763635/100

MUNICIPAL DEBT OBLIGATIONS

The total amounts of outstanding municipal debt obligations

(including principal and interest) secured by property taxes is

$33,144,167.

This cover page and the information it contains are included with the adopted budget as required by Section

102.007 of the Texas Local Government Code.

CITYOFKENNEDALE.COM/FINANCE 3