Page 25 - HaltomCityFY26Budget

P. 25

City Of Haltom City Adopted Budget, FY2026 Budget Overview

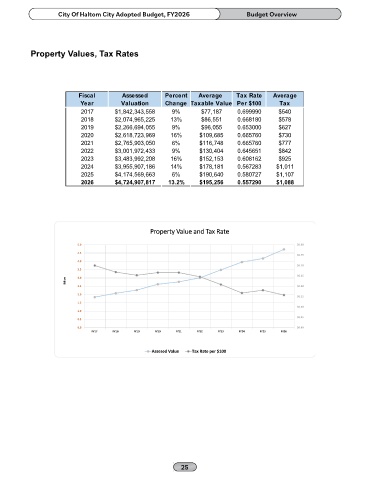

Property Values, Tax Rates

Fiscal Assessed Percent Average Tax Rate Average

Year Valuation Change Taxable Value Per $100 Tax

2017 $1,842,343,558 9% $77,187 0.699990 $540

2018 $2,074,965,225 13% $86,551 0.668180 $578

2019 $2,266,694,055 9% $96,055 0.653000 $627

2020 $2,618,723,969 16% $109,685 0.665760 $730

2021 $2,765,903,050 6% $116,748 0.665760 $777

2022 $3,001,972,433 9% $130,404 0.645651 $842

2023 $3,483,992,208 16% $152,153 0.608162 $925

2024 $3,955,907,186 14% $178,181 0.567283 $1,011

2025 $4,174,569,663 6% $190,640 0.580727 $1,107

2026 $4,724,907,817 13.2% $195,256 0.557290 $1,088

Property Value and Tax Rate

5.0 $0.80

4.5

$0.75

4.0

$0.70

3.5

$0.65

3.0

Billion

2.5 $0.60

2.0

$0.55

1.5

$0.50

1.0

$0.45

0.5

0.0 $0.40

FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26

Assesed Value Tax Rate per $100